Weekly Outlook | Positive Risk Sentiment While The Dollar Keeps Rising

Financial markets show early signs of a consolidation. US indices went higher with the S&P 500 index having created a new all- time- high last week while the Nasdaq still continues to lag behind. The shift in markets seems to continue and currently the renewed strength of the Dollar might weigh on the positive momentum. Speaking of which, despite a weaker than expected NFP report the Greenback keeps pushing to the upside. Further strength of the Dollar might hence cause stock markets to stall potentially causing some negative sentiment to push markets lower. This week’s economic data might hence give further insights into markets and offer guidance on potential developments of the Fed.

Important events this week:

– US consumer price index– The consumer price index from the United States might offer further insights into the US economy. Rising prices typically cause consumers to spend less, which causes the economic activity to weaken. Vice versa figures have most stabilized for the past six months causing the Fed to resume their path of cutting interest rates. That, in turn, will support the economy again, which would help stock markets to potentially rise.

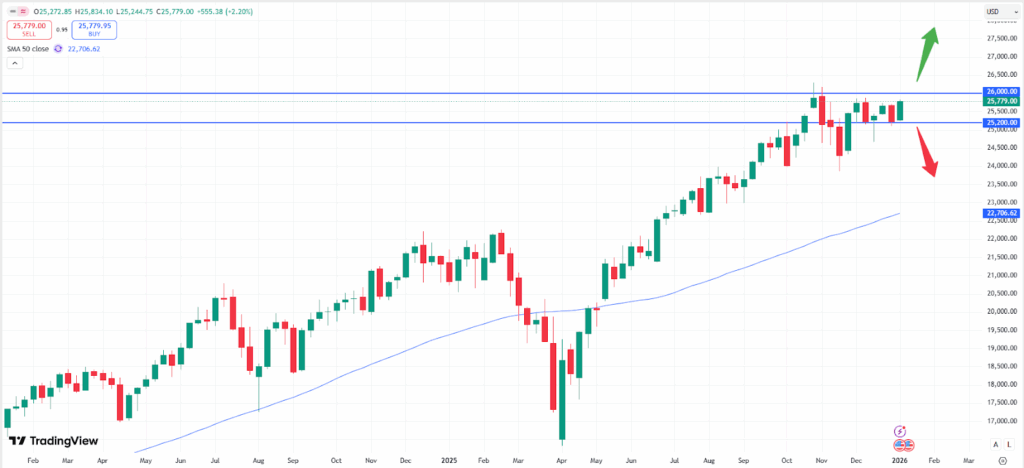

Nasdaq weekly chart

As the weekly chart above shows, the Nasdaq remains on track to push higher. Yet, since the market keeps lagging behind the S&P 500, a potential correction might be sharper in this market. Traders should hence pay attention to the support zone of 25.200 points. A break below might indicate that prices will proceed lower again. On the other hand, the positive momentum might also cause the market to break to the upside. A push beyond the technical resistance zone of 26.000 points might unleash a strong move higher. The data will be released on Tuesday, 13th of January at 14:30 CET.

– UK Gross domestic product– Despite being a rather backward-looking indicator the GDP figure from the UK might also move markets. It is expected that the figure will rise slightly from the previous -0.1% to 0.0%. A better-than-expected release might support the Pound, which kept losing steam against other currencies again last week.

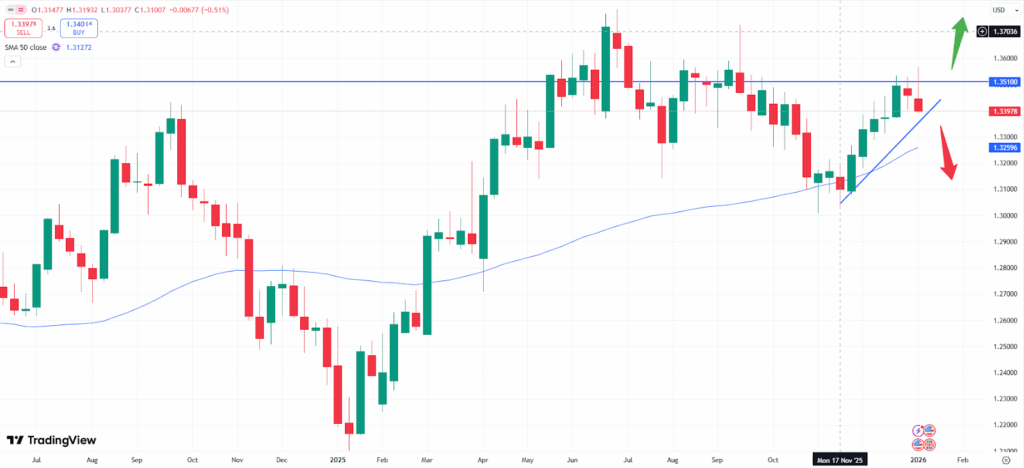

GBPUSD weekly chart

The weekly chart of the GBPUSD shows that the chart created a negative pinbar candlestick. This shows, that the market might be ready to break lower, if the high at 1.3510 will not break. As the area marks a clear technical resistance zone, downside momentum could now be on the cards. Furthermore, also the slightly negative news in regards to the NFP report did not cause the Dollar to lose momentum. Instead, after some initial weakness the Greenback resumed its positive momentum. A better- than- expected results of the GDP figure might help the Pound, though, and hence push the market beyond the resistance zone. Traders should hence focus on the release of the report for further guidance.