Weekly Outlook | Important Data To Guide Markets

This week will feature an array of important data, which has the tendency to move markets. The news will start on Tuesday with the RBA interest rate decision from Australia. As the risk sentiment is currently positive the decision might move the Aussi. Currently, no rate cut is being expected.

The heat might get hotter on Wednesday with both the Bank of Canada as well as the Federal Reserve deciding upon their interest rates. No change is expected from the BoC, which had cut rates during their last meeting in October. The FOMC rate decision we will discuss below.

Furthermore, also the Swiss National Bank from Switzerland will hold their interest rate decision, which is not expected to change their approach.

With all the news events traders should prepare for a busy week and hence adjust their trades accordingly as an increase in volatility should be expected.

Important events this week:

AU interest rate decision: It is expected that the RBA will leave the interest rate at the current level at 3.60%. With no change expected the AUD might hence remain strong and could even push to the upside against other currencies. A look at the monthly chart reveals, that the technical support zone at 0.6525 has not been broken, which might now indicate further upside momentum. Based on the weekly chart below the upside has been strong during last week’s trading.

If the price can now break the technical resistance zone at 0.6650 the positive trend might be due to continue. Retracements might also be used to enter into the market with fresh buy positions at lower levels. The interest rate decision will be held on Tuesday, 09th of December at 04:30 CET.

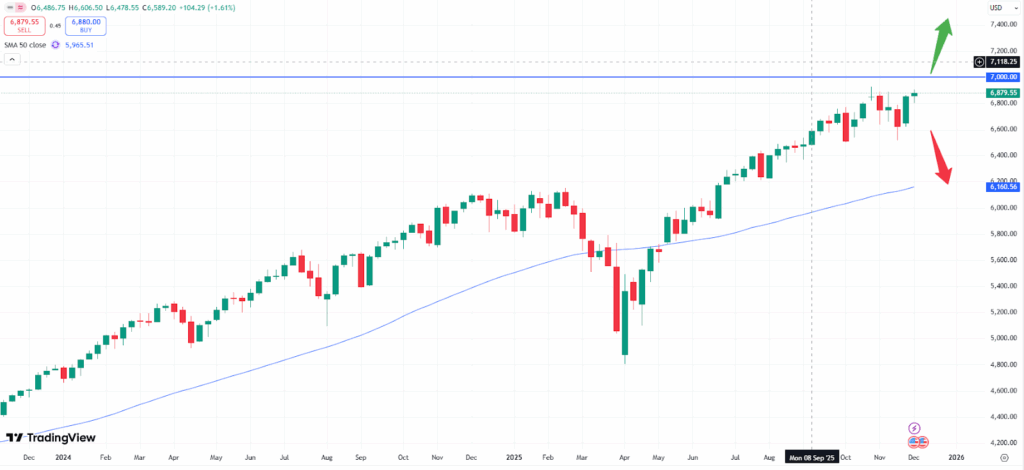

US FOMC interest rate decision: The interest rate decision in the US is expected to shake up markets. First of all, it is expected that that the interest rate will be reduced from the current 4.00% down to 3.75%. The labor market currently shows weaker momentum, whereas also inflationary pressure seems to weaken further. Both are signs that the FED is expected to act to support the economy overall. A cut in rates usually helps the underlying currency to weaken. The injection of fresh liquidity in markets will also support equities. Indices like the S&P500, Nasdaq or Dow Jones might hence move to higher levels.

The S&P 500 index shows, that the demand remains steady and that fresh upside momentum might be on the cards. Based on the weekly chart, the breakout to the upside might be well in the making. With the strong upside momentum during the last trading days in November, the positive trend is expected to continue. A break above the psychological level of 7,000 might then unleash fresh upside momentum.