Weekly Outlook | Dollar Weakness And Positive Risk Sentiment

Last week the Dollar lost further steam and continued to weaken against other currencies. Most currencies ended the week positive and this week might shed more light into the recent moves. While the EUR might move higher also the GBP could follow the same path. The PCE index from the US might also support current moves as the preview for the meeting of the Federal Reserve on the 10th of December. Falling prices might support the Central Bank to cut rates which is currently expected. The Greenback could then lose momentum even further.

Important events this week:

US ADP nonfarm employment change: Following the shutdown in the US the recent report had seen an increase in jobs from the previous negative figure to 42,000 positions. Whether the uplift can continue remains to be seen. This month’ data suggest that only 19,000 jobs have been added indicating another slowdown in the economy. The Fed might hence continue with their path and follow up with another rate cut anytime soon.

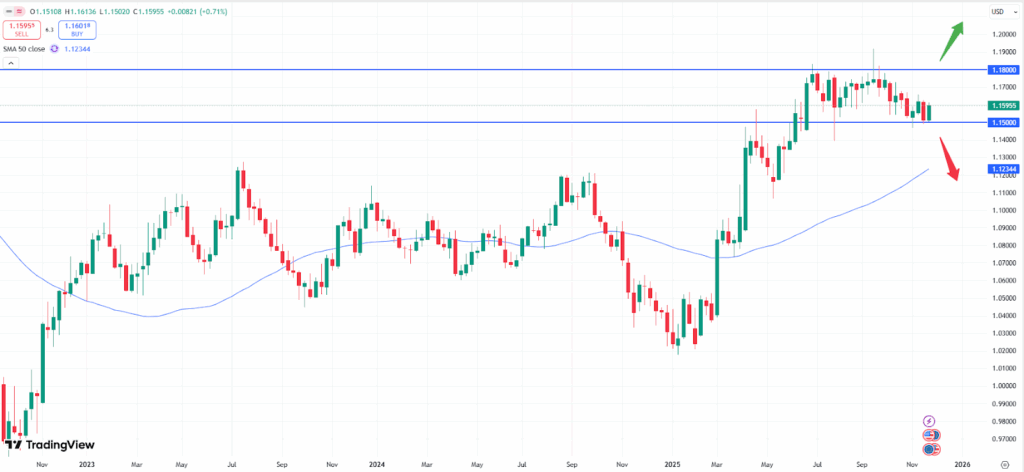

The EURUSD currency pair seems to be reactive already showing a potential rise to the upside.

The weekly chart of the currency pair shows, that the trend remains stuck within a sideways pattern. A breakout from this zone is expected to happen and might occur into either direction. While the market currently keeps losing momentum the technical support zone of 1.1500 remains solid indicating a potential rise in prices. Should the price weaken further the next support can be found at around 1.1240, where the 50- moving average might act as support as well. A weaker reading is expected to help pushing this market higher. The data will be released on Wednesday, the 03rd of December at 14:15 CET.

US PCE price index: The price index is expected to weaken further, which is somewhat in contradiction to what US consumers generally feel. Since the Covid- 19 pandemic prices have been rising sharply as mainly reported. Yet, following the official release of the price index, prices are expected to fall slightly. This, in turn, might also support the Dollar moving lower again.

The monthly chart shows, that the recent retracement of the S&P 500 index has been fully retraced during the last trading days of November. Following the recent move to the upside the market might now be fully set for a breakout and create a new all- time- high. The market might hence be set for a year- end rally in US stocks, given the potential outcome of the news. If the 6,900 points level can be crossed the market might rise quickly towards the psychological resistance zone at 7,000. The PCE index will be released on Friday, the 06th of December at 16:00 CET.