Trump ups ante on Iran as markets fade soft CPI

* Dollar pares losses after CPI as yen tumbles on Japan spending fears

* Gold and silver post more record highs, amid several drivers

* President Trump says Iran will pay ‘big price’, help ‘on its way’

* JPMorgan profit falls on investment banking miss, Apple card charge

FX: USD found a bid after the softer than expected CPI data. Core m/m and y/y both came in a tenth cooler than anticipated, while headline m/m and y/y were in line at 0.3% and 2.7%. Markets looked through the data as distortions may persist for some time until a “cleaner” picture of price trends emerge in the spring. That means it is unlikely to alter the Fed’s current wait-and-see approach with nothing priced in for the January FOMC meeting. Geopolitical stories continue to grab the market’s attention with President Trump’s loud rhetoric on Iran boosting oil markets.

EUR fell back to the 50-day SMA at 1.1645. Economic releases have been thin with broader developments the main theme. Rate differentials between the EUR and USD have widened to levels last seen in November, which means potentially more pressure on the euro.

GBP dipped with domestic drivers limited at this time. BoE rate cut expectations are steady following their recent pullback, with markets still pricing in at least one 25bp move by June and nearly 50bps by December.

JPY lagged again and is the major underperformer this week. In effect, the “Takaichi trade” is extending as the PM confirmed her intent to hold snap elections with her popularity in polls high. She is a fiscal and monetary dove. USD/JPY closed on its high of 159.19, with intervention coming into sight with the psychologically important 160 being the line in the sand. The July 2024 top sits just below 162. Overnight, the finance minister Katayama had said she shared concerns with US Treasury Secretary Bessent over the weak yen, which saw modest USD/JPY downside.

US stocks: The S&P 500 lost 0.22%, closing at 6,962. The Nasdaq moved lower by 0.18% to finish at 25,742. The Dow settled lower by 0.82% to close at 49,182. Energy was the standout sector with gains seen in Crude (see below) and five sectors were in the red, as Financials sharply underperformed bringing the Dow down with it. JP Morgan dragged the big banks lower as it kicked the Q4 earnings season. The stock closed down 4.2% as revenue and EPS for the current quarter missed estimates, even this year’s outlook impressed. President Trump’s credit card interest rate cap plan hasn’t gone down well with Visa and Mastercard falling for a second day. JPM Chief Jamie Dimon warned that the White House’s attacks on the Fed could boost inflation. Intel surged 7.3% on media reports that there may be a CPU shortage.

Asian stocks: Futures are mixed. APAC stocks were mostly in the green again. The ASX 200 saw metals and miners outperform, continuing this week’s gains. The Nikkei 225 jumped after its long weekend and posted fresh record highs. The weaker yen and increasing speculation of a snap election and more fiscal stimulus boosted stocks. The Hang Seng and Shanghai Comp were both bid on broad positive risk sentiment though the mainland lagged.

Gold made another new high intraday at $4,634 before closing modestly below. There’s a host of reason for the strong bid already this year, which include geopolitical risks, elevated fiscal uncertainty, strong central bank demand, and ongoing concerns about inflation and monetary credibility. Fed independence can be added too.

Day Ahead – US Retail Sales

Consensus expects both the November headline and control group to rise 0.4%. Holiday item spending was strong in October and November but slowed around Black Friday and Cyber Monday, according to some data, suggesting some consumers shopped earlier for deals. The consumer is the major engine of the US economy with spending consistently accounting for roughly 70% of its GDP. That makes it a key indicator for overall economic health, hiring and investment decisions.

The ‘k-shaped’ economy theme appears to still be playing out as the top 20% of households by income continue to spend strongly, boosted by incomes and soaring wealth. Meanwhile the bottom 60% struggle with concern about job security and potential tariff-induced price hikes. There is now roughly 70% chance of a rate cut by the June FOMC meeting.

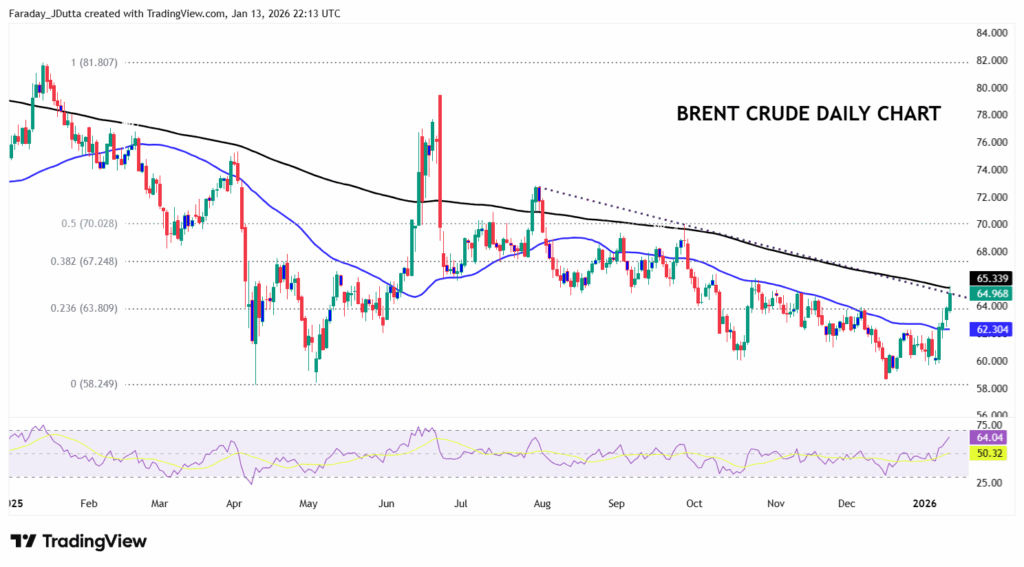

Chart of the Day – Oil bouncing on geopolitics and supply disruptions

Brent crude spiked higher yesterday on news that President Trump had cancelled meetings with Iran and ‘help was on its way’ to the protesters. President Trump also announced a 25% tariff on countries trading with Iran, targeting China as a major oil buyer. It is uncertain whether this threat will deter China from purchasing Iranian oil. Chart wise, prices dipped to levels last seen in May last year in mid-December. But that zone was a long-term support area around $58 which stayed strong and held. Since then, prices steadied above $60 before enjoying a strong push higher through the 50-day SMA at $62.30, which had previously capped the upside from August. We’ve now reached the 200-day SMA at $65.30 with the major Fib level (38.2%) of the 2025 high to low at $67.24. The price increase coincides with the growing protests in Iran and possible US intervention.