Tech outperforms as USD steady ahead of FOMC

* Stocks start the FOMC week lower, rate cut fully priced in

* USD modestly firmer as investors brace for ‘hawkish’ Fed

* Paramount gatecrashes Warner Bros-Netflix deal with $108bn hostile bid

* Nvidia can sell H200 AI chips to China, Trump says

FX: USD was marginally better bid as it continued to trade below the 50-day SMA at 99.16 and just around the mid-November lows. The Fed is widely expected to cut rates this week, with updated quarterly dot plot and economic forecasts of most interest. Jobs data today will be in focus with a ‘hawkish hold’ likely the consensus for the FOMC meeting.

EUR printed a doji as the major traded unchanged around the 100-day SMA at 1.1643. The single currency held up as ECB hawk Schnabel said she is ‘comfortable’ on bets that the next move will be a hike, albeit not any time soon, according to Bloomberg. Little notable reaction was seen in ECB pricing through 2026, which remains unchanged for rates.

GBP continued to consolidate Wednesday’s upside move with cable trading around the 200-day SMA, now at 1.3329. The 100-day SMA sits above at 1.3363. It remains quiet on the UK data front as markets look to the December 18 BoE meeting where a rate cut is expected, and CPI data release just before. Former PM Tony Blair is reportedly exploring alternative Labour leadership options amid frustration with UK PM Starmer’s direction, according to weekend press reports.

JPY weakened for a second straight day as the major found support at a minor Fib level of this year’s high to low move at 154.81. Interest rate differentials are dominating as US yields climb to levels last seen in September. That said, a 25bps rate hike by the BoJ is fully priced in for its December meeting in a couple of weeks. Monday data was soft, with disappointing real cash earnings and a weaker revision to the final Q3 GDP figures. A 7.6 magnitude earthquake and tsunami advisory also featured.

US stocks: The S&P 500 lost 0.35%, closing at 6,847. The Nasdaq moved lower by 0.25% to finish at 25,628. The Dow settled lower by 0.45% at 47,739. Tech was the only sector in the green with Communication Services, Materials, Consumer Discretionary and Utilities leading the laggards. Communications were driven lower by Alphabet (-2.37%) and Netflix (-3.44%) The latter fell due to an attractive all-cash Paramount SkyDance bid for Warner Brothers Discovery. The proposed deal is for $108.4bn. President Trump also voiced antitrust concerns regarding Netflix’s planned $72bn deal. Tesla (-3.4%) weighed on Consumer Discretionary after receiving a downgrade at Morgan Stanley due to its high valuation, a more cautious EV outlook, and non-auto growth being priced in. The US will allow Nvidia to sellH200 chip exports to China; the stock gained 1.7%.

Asian stocks: Futures are mixed. APAC stocks were mixed with few major weekend drivers. The ASX 200 was muted ahead of this week’s RBA meeting and mixed trade data. The Nikkei 225 traded amid mixed data and continued geopolitical China tensions. The Hang Seng and Shanghai Comp were mixed as well, with the former hurt by big bank losses trumping tech gains.

Gold traded in a narrow range closing modestly lower. Treasury yields moved quite sharply higher with the 10-year jumping up to 4.17%, having dipped to 3.96% at the end of last month. The FOMC meeting is in focus and what happens after the fully priced 25bps rate cut on Wednesday. Data over the weekend showed that the PBoC increased its gold reserves for a 13th consecutive month.

Day Ahead – RBA Meeting, Jolts US jobs

The RBA is fully priced to remain on hold and keep the cash rate at 3.6%. Inflation and growth data has generally surprised to the upside since November, with price pressures noticeably accelerating further in October with CPI rising above the 2-3% target range. Many economists say the balance of risks has tilted towards a hike as the next move. Some even predict a ‘hawkish hold’ in case policymakers are forced to lift rates next year. Money markets see a near 35% chance of 25bps rate hike by August 2026.

JOLTS US jobs data is expected to show the labour market softened modestly in both September and October. The total number of openings likely slid, along with the ratio of vacancies to available workers. The headline print is predicted to print at 7.13mn in October, down 90k since August – the last month for which the BLS released data. This additional labour market slack comes amid workers less likely to quit in search of higher pay – the low-hire/low-fire environment that has emerged.

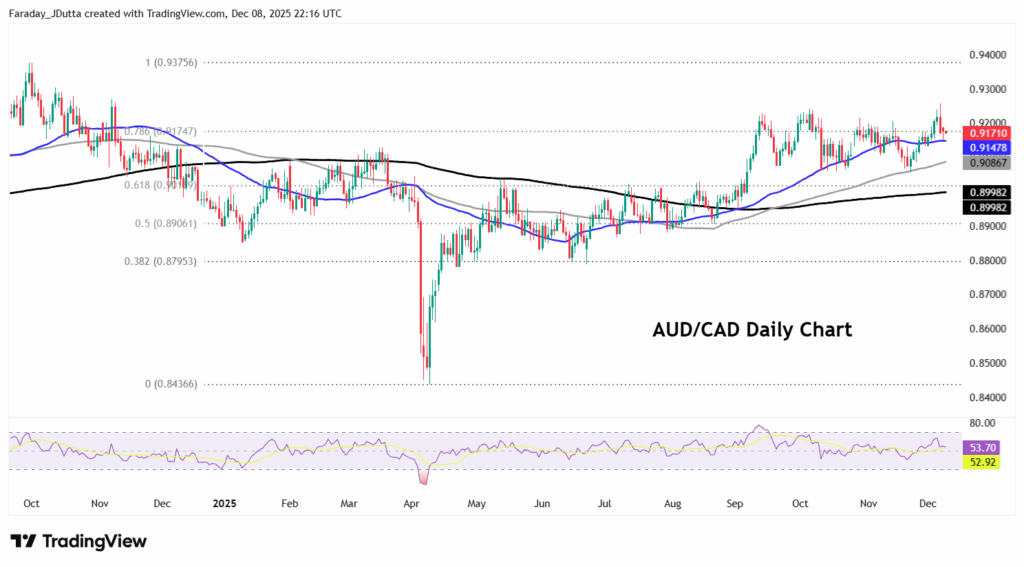

Chart of the Day – AUD/CAD back in the range

Gains in this popular pair extended above the ceiling of the recent range that has prevailed for the cross since mid-September. After a period of range trading between 0.9060 and 0.9240, the bullish move in some daily momentum indicators suggested a more dynamic phase of price action may develop. But a break to a new, higher range between 0.9250/0.9375 failed. The current range ceiling at 0.9240 remains major resistance now. Prices have fallen back to the 50-day SMA at 0.9148 and below a Fib retracement level (73.6%) of the September 2024 high to April 2025 low at 0.9174.