Tech leads risk rally as December rate cut odds jump

* Stocks surge, US yields fall as Fed rate cut bets increase

* Wall Street ends higher on tech rebound, Alphabet hits fresh record highs

* Gold rises as Fed easing expectations ramp up

* Kremlin aide expects direct US-Russia contact on plan soon

FX: USD tracked sideways for a third straight day, printing an inside candle. That denotes consolidation and some indecision. The 200-day SMA sits below at 99.85. Friday saw NY Fed President Williams’ dovish comments on the rate outlook Friday – he saw room for a rate cut in the “near term – have had an outsized impact on rate expectations. Money markets have moved from pricing in less than 10bps of easing (40% chance) to more than 20bps (80%+ chance) at the December FOMC meeting. Williams is a leading member at the Fed, but some are questioning such a large move, when other officials still appear not to back a rate move next month. The Ukraine-Russia peace plan continues with a seemingly long way to go to any kind of concrete agreement.

EUR was very mildly bid in quiet FX trade. The German IFO business sentiment figures were largely in line with expectations and largely unchanged from the prior month. This week’s data highlight will be the German CPI figures scheduled for Friday. Near-term support is around 1.15 with this month’s swing low at 1.1468.

GBP was ticked higher in a narrow range day for a third day in a row. The downward trendline from the September top sits around the August low and major fib level (38.2%) of this year’s rally at 1.3140. The 50-day SMA looks like it is going to fall below the 200-day SMA which would form a bearish death cross signal. All eyes are on Wednesday’s Budget with more leaked plans for the many minor tax hikes that are predicted.

JPY underperformed its peers but printed an inside day after Friday’s fall in the major. The 10-year Treasury yield fell for a third straight day, nearing 4%. But the dollar has completely disconnected from yield spreads and broader fundamentals.

US stocks: The S&P 500 added 1.55%, closing at 6,705. The Nasdaq moved higher by 2.62% to finish at 24,874. The Dow settled up 0.44% at 46,448. Communications jumped 3.9%, led by Alphabet after more upbeat commentary on its latest AI updates (Gemini 3) which saw it hit more record highs. Tech gained about 2.5%, led by Broadcom surging +11%, and consumer discretionary gained 2.0%. Alibaba jumped over 5% as its relaunched Qwen AI surpassed 10mn downloads in its first week. Tesla added over 6.8% after Elon Musk announced to grow its AI chips business. Novo Nordisk sunk more than 5.8% after Ozempic failed Alzheimer’s trials, while Eli Lilly added 1% to hit more record highs, after it joined the $1 trillion market cap last week. Both the S&P 500 and Nasdaq are nearing their 50-day SMAs at 6,709 and 24,947 respectively.

Asian stocks: Futures are green. Stocks were mostly positive after the better day Stateside. The ASX 200 saw tech and industrials outperform with mixed M&A news. Qube surged to a record high on Macquarie Asset Management’s fresh takeover proposal. Conversely, BHP shares trickled lower after it was reported to have made a renewed approach for Anglo American, which was rejected. The Nikkei 225 was closed for a Japan holiday. The Hang Seng and Shanghai Composite were mixed with tech gains after President Trump’s team internally floating the idea of selling Nvidia chips to China.

Gold pushed offthe major Fib retracement level (38.2%) of the early September break to the record high in November at $4,044. The next minor Fib level is at 4,173. Bullion gained 1.8% as Treasury yields moved lower as Fed rate cut bets increased.

Day Ahead – US Retail Sales

This is important data as it will give us an insight into the US consumer and consumer spending, which makes up more than two-thirds of US economic activity. That said, it is the delayed September data so slightly stale. Consensus expects the headline to rise 0.4% versus the prior 0.6%, the core at 0.3% and the control group at 0.3%, previously 0.7%.

Lower and higher income groups appear to be diverging in a tale of two consumers, with the latter benefiting from wealth effects. It’s Black Friday this week which heralds the start of the important holiday shopping season. Black Friday is the day after Thanksgiving that ushers in holiday sales and arrives as data has shown consumer sentiment slumping and inflation staying firm.

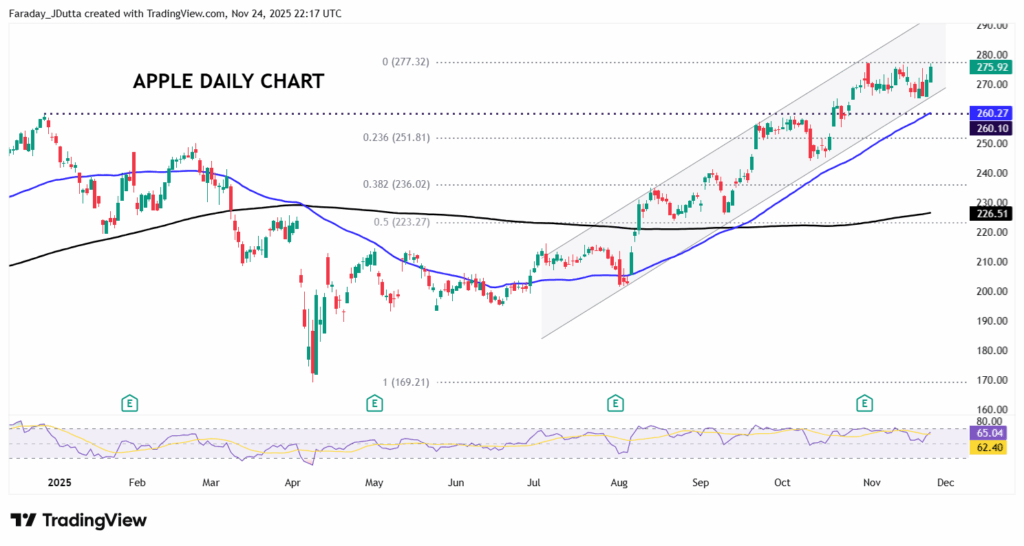

Chart of the Day – Apple could be bullish consolidation mode

News that Apple was cutting thousands of jobs across its sales orgnaisation was a very rare layoff signal from the iPhone maker. Chartwise, prices have consolidated in recent weeks though price action has been strong over the last two days, having traded at the bottom of the recent range around $265 in the latter part of last week. The stock also touched the lower part of the bull channel seen since lows in the summer. Bulls have enjoyed the rebound off that support to the top end of the range, just below the record high at $277.32. More bullish momentum could take the stocks to a fresh all-time top.