Stocks mixed, USD quiet ahead of CPI

* More record highs for Wall Street, Oracle rockets 36% higher

* Dollar modestly bid versus yen and euro after producer price data

* Gold close to all-time highs driven by safe haven demand

* ECB set to hold rates again, US CPI watched for tariff-induced price pressures

FX: USD was very quiet as it traded in a tiny range just below the 50-day SMA at 98. The BLS revisions were still being talked about with various reasons as to why we saw a bid in the buck – old data that will be revised again, rumour/fact type price action. PPI data was cooler than expected ahead of today’s CPI figures. Typically, when both headline and core producer prices move in the same direction, so too do consumer prices. A court ruled that President Trump didn’t have cause to fire Fed Governor Cook, but an appeal is likely, followed by a Supreme Court ruling. As we said previously, this will be a long drawn-out affair seen in different courts.

EUR printed a narrow range day ahead of the big risk events of the week. The single currency was not helped by rising geopolitical tensions in Poland who responded to the violation of its airspace by Russian drones. US President Trump reportedly called for the EU to impose 100% tariffs on China and India to pressure Russian President Putin. In truth, it was a remarkably steady day before the ECB and US CPI data. See below for more.

GBP was marginally higher with little news to impact the major. UK-US yield spreads have pushed to fresh highs with next week’s BoE and FOMC meetings coming into view. No changes are expected from the MPC, in contrast to the re-start of policy easing at the Fed.

JPY traded pretty much flat on the day, printing a small doji, as markets assessed domestic political issues and possible BoJ rate hikes. The ruling party’s LDP leadership is hotting up, ahead of the early October vote. Tuesday’s price action saw a bullish hammer candle as prices returned to the technically important 50-day SMA at 147.49.

AUD outperformed strongly again as the major hit levels last seen in November. A fresh high was posted at 0.6635, just above the July peak at 0.6625 before prices retraced. CAD lagged and underperformed all of its peers except CHF. AUDCAD made fresh highs. The loonie has failed to reflect narrower US/Canada short-term spreads and appears to have been weighed down by, rather than benefitting from, the softer tone in the USD broadly.

US stocks: The S&P 500 gained 0.31% to close at 6,533, another record high. The Nasdaq rose by 0.04% to settle at 23,849, a third straight record closing high. The Dow Jones finished at 45,491, down 0.48%. Sectors were mixed, with Tech, Energy and Utilities outperforming while the underperforming sectors were Consumer Discretionary, Consumer Staples and Health. Communication names also lagged, with weakness in Amazon and Meta weighing on Discretionary and Communication sectors. Oracle surged 40% higher intraday after its update overnight on Tuesday. It missed Q1 expectations on EPS and revenues, but a key metric showed a huge backlog of signed cloud deals were yet to be recognised as revenue going forward. $300bln out of the $455bn orders appears to be from OpenAI, according to the WSJ. This news only emboldened the high demands for the AI market and helped support AI infrastructure names with Nvidia adding 3.85%.

Asian stocks: Futures are mixed. Stocks traded mostly positive after record closing highs in the three main stock market indices on Wall Street. The ASX 200 edged higher staying above support at the 50-day SMA. Financials and tech strength offset mining and materials losses. The Nikkei 225 moved north closer to 44,000 again, despite hawkish talk about BoJ rate hikes, even as early as October. The Hang Seng and Shanghai Comp both gained with tech boosting the Hong Kong index while the mainland lagged on deflationary CPI and President Trump asking the EU to hit China with 100% tariffs in order to pressure Russian President Putin.

Gold found a bid again as bugs tried to erase Tuesday’s sell-off. That saw prices print an inverted hammer pattern which is typically bearish as it is often seen at the top of the trend and the start of a new downward bias.

Day Ahead – US CPI, ECB Meeting

Consensus expects US headline CPI to rise by +0.3% m/m in August, higher than the prior +0.2%, and 2.9% y/y. The core is also seen rising by +0.3% m/m, in line with July’s print, and 3.1% y/y. Markets will be watching the data again for signs of any further tariff pass-through which could become more evident in the coming months as firms increase imports amid falling inventories. There is likely to be more evidence of goods price inflation being triggered by tariffs. However, core goods – items most vulnerable to a tariff impact – are only 19% by weight of the inflation basket. On the flip side, housing costs are 33% by weight, and there is likely to be more evidence of softening rents, based on various measures like Zillow data and the Cleveland Fed’s gauge.

The ECB is set to hold rates at 2%, with President Lagarde likely to reiterate that policy remains in a good place, suggesting that policymakers are not in a rush to adjust policy. Since July’s meeting, the EU-US trade deal has been agreed. On the data side, Q2 growth was resilient in the face of trade tensions. More timely survey data, the composite PMI metric, moved further into expansionary territory with the pace of expansion ticking up to a one-year high. On the inflation front, the headline did rise one-tenth to 2.1% while the core held steady at 2.3%. All in, there is little cause for policymakers to loosen policy at this meeting, and markets see that going forward into 2026. Focus will be on the new quarterly economic projections, and the 2026 inflation forecast which may tick lower.

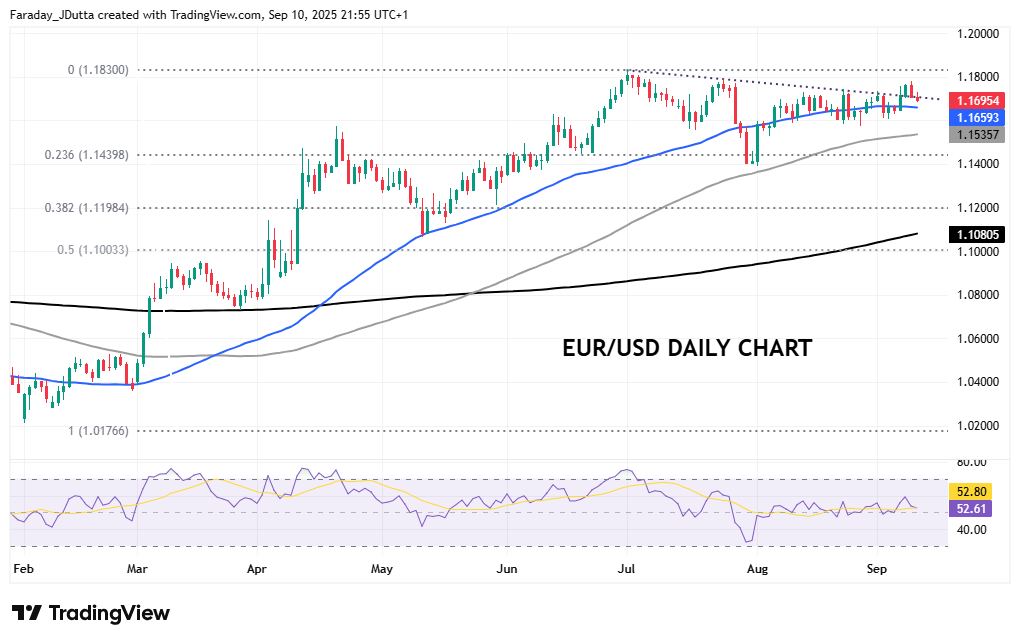

Chart of the Day – EUR/USD hovering below multi-year highs

We obviously get two big risk events within an hour or so of each other. Note that the US CPI data comes after the ECB decision, which will be unchanged, but before the ECB press conference. How hawkish will President Lagarde be? Risks are tilted that way, certainly if the ECB sees that uncertainty has receded, plus if we get a cooler inflation print, then EURUSD should rally towards 1.18 and the multi-year top is 1.1830 with ECB/Fed divergence in play. US inflation will be the last main data point ahead of the Fed’s 17 September FOMC interest rate decision next week. A 25bps rate cut is nailed on, with around a 10% chance of a bigger 50bps move, and the prospect of 125-150bps over the next nine months. The 50-day SMA has been a pivot point and sits at 1.1659 with 1.16 a zone of support. Prices remain on the descending trendline from the July high.