Stocks mixed amid soft jobs data and Fedspeak

* Nasdaq, S&P 500 rise with Alphabet, Apple boosts

* Alphabet soars to record highs as Google dodges antitrust breakup demand

* Dollar drops against peers with jobs data under the spotlight

* Gold shines again with fresh high amid haven demand and rate cut hopes

FX: USD gave back some of its gains from Tuesday as the 100-day SMA at 98.70 looks to be acting as resistance again, after capping the upside in early August. Job vacancy data came in softer than forecast. This is a gauge of labour demand though the print was still well above the 7mn average pre-pandemic in 2018-19. Some focus may be on ADP data out later today, but this is rarely ever a good pointer to the NFP figures due on Friday. The 50-day SMA continues to act as a pivot at 98.14. We heard from Fed officials including Waller, who repeated his September rate cut call but backed a data dependent stance afterwards.

EUR lagged its peers with bond markets turbulence less of a focus. ECB pricing remains steady with around 8bps seen in December, so a 32% chance of a 25bps cut. Prices continue to trade around the 50-day SMA which is at 1.1664. The one-month range still holds between the upper 1.15s and lower 1.17s. As we always say, the longer price action is rangebound, the bigger the breakout will be.

GBP was near the top of the major currency charts on Wednesday as bond markets calmed. The fiscal picture will be a focus into the autumn budget in late November. But repricing of a more hawkish BoE is important. This was highlighted by comments from Governor Bailey who said rate cuts could come at a slower pace than previously expected. Support sits around 1.16and the 50-day SMA now sits at 1.3464.

JPY lagged other major currencies but strengthened mildly against the dollar. Long end JGB yields hit record highs on Wednesday, not helping the yen. Remember that bond market volatility put paid to any BoJ rate hikes in April, forcing a pause in the tightening cycle. Prices touched the 200-day SMA at 148.76 before retracing, as they did at the end of July/start of August.

AUD outperformed again, getting a hand with better-than-expected GDP data which came in one-tenth at 0.6%. That pushed the y/y figure to the fastest in nearly two years at 1.8%. RBA rate cut bets slid with 44bps seen in total, versus 50bsp pre-release, with a fully priced move in November.

US stocks: The S&P 500 gained 0.51% to close at 6,448. The Nasdaq rose by 0.79% to settle at 23,415. The Dow Jones finished at 45,271, down 0.05%. Breadth was soft with the majority of sectors down, and decliners outpacing advancers, with small caps and the equal-weight S&P underperforming. Alphabet surged 9% to fresh all-time highs above $230 after a court ruling against the breaking up of Google’s parent, clearing a big regulatory cloud. One analyst called it a ‘home run ruling’. The news helped Apple gain 3.8%, as the ruling would let Google make payments to the iPhone maker. Google can no longer sign exclusive search and app distribution deals but it can still pay for default placement annually. This also removes the regulatory overhang on Apple and was seen by Wall Street as a ‘net positive’ and even a ‘monster win’.

Asian stocks: Futures are positive. Stocks were mainly softer and dampened by global debt concerns amid a higher yield environment. The ASX 200 pulled back with the declines led by underperformance in tech, utilities and financials. Slightly stronger-than-expected Australian GDP data failed to help the bulls. The Nikkei 225 was pressured amid a higher global yield environment but with the downside initially cushioned by recent currency weakness. The Hang Seng and Shanghai Comp slipped with attention in Beijing on the military parade attended by Russian President Putin and North Korean Leader Kim, much to the ire of US President Trump.

Gold surged to more record highs at $3,578 finishing off the highs. As we said yesterday, the environment is attractive for bugs with high safe haven demand and falling real yields front and centre. Friday’s NFP will help or hinder the recent rally, though a September rate cut looks nailed on.

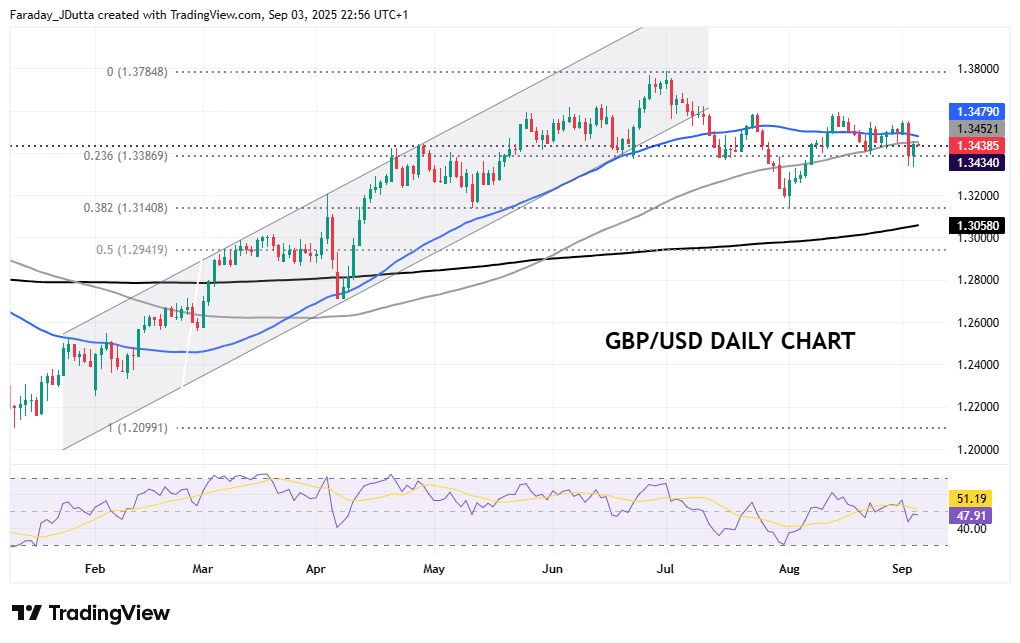

Chart of the Day – GBP/USD volatility

Global bond market jitters have hit sterling the most this week, with the Government’s parlous fiscal situation in the spotlight. As we wrote yesterday, there was no special catalyst for Tuesday’s volatile session. The doom loop of higher inflation, lower growth, high debt and potentially rising taxes is a bad environment. But some perspecitve is also needed in that Gilts didn’t underperform their peers on Tuesday and the 10-year Gilt auction was 10 times oversubscribed, raising a record £14bn. Headlines comparing the situation to the 1970s seem wide of the mark, at least at present. GBP has actually done well recently, due to hawkish repricing of BoE rate expectations, rather than fiscal worries. Support looks good around 1.3434, a swing high from September. The 50-day SMA sits at 1.3479 as a pivot.