S&P 500 and Dow hit record highs, Tech still lags

* Stocks make more gain as focus turns to jobs data

* Gold continues higher, with fresh closing highs in silver

* Dollar appreciates to over two-week closing high

* Security guarantees for Ukraine ‘largely finished’, Trump eyes Greenland

FX: USD was firmer and recovered from initial losses. News flow in the FX space was fairly thin, although Services PMI was revised lower than expected, in addition to Fed speak from Miran and Barkin. The former reiterated his usual uber-dove tones, while the latter said currently policy rate is within the range of neutral. There’s still some focus on the geopolitical picture, but as is usual, these kinds of tensions don’t especially impact markets long-term. The de-dollarisation theme is a possible story but has many different guises. Seasonals are good for dollar bulls, and especially in February.

EUR was pressured in wake of a slew of data, which started with French PMI revisions, then German Composite and EZ PMIs were also revised down, amid further weakness due to softer German state CPIs. The euro still remains supported on a fundamental basis with EZ-US yield spreads hovering around multi-year highs. The 50-day SMA sits at 1.1640 while the daily RSI has slipped below 50 implying a pick up in bearish momentum.

GBP hit fresh cycle highs at 1.3567, a level last seen in mid-September, before sellers stepped and bought the dollar. Sterling is vulnerable to broader themes and a plethora of US data for the rest of this week, with little on the UK calendar.

JPY lost ground versus the dollar as the major inched higher. But JGB yields have pushed north again as markets shift their expectations for both the BoJ and their outlook on inflation.

US stocks: The S&P 500 added 0.62%, closing at 6,945, a fresh record high. The Nasdaq moved higher by 0.94% to finish at 25,640. The Dow settled higher by 0.99% to close at 49,462, another new all-time high. Energy was the clear underperformer this time while Materials, Health and Industrials were the clear winners, rising between 1.3% and 2%. A clear cyclical rotation is continuing, though once again not led by technology which is lagging. That said, chip producers were higher having underperformed recently. Chevron pared yesterday’s gains while refiners moved lower too. Eli Lilly bounced back as Novo Nordisk continued to gain as it kicked off a weight loss drug price war. It was the first record close of 2026 for the benchmark S&P 500 index and it has risen for three straight days. Even though there was no official Santa rally, for a third year in a row, there are hopes that January can be positive.

Asian stocks: Futures are mixed. APAC stocks were mostly higher following the positive handover Stateside, from gains in energy and a softer yield environment. The ASX 200 was the laggard with the index dragged lower by weakness in defensives and the top weighted financial sector. The Nikkei 225 rallied at the open to back above the 52,000 level with the advances led by mining and tech-related stocks. The Hang Seng and Shanghai Comp conformed to the predominantly upbeat mood, with outperformance in Hong Kong helped by strength in some property names and miners. Aluminium prices printed fresh three-year highs.

Gold moved higher for a second day with strong buying again. The all-time top from late December sits at $4,550. Haven demand seems obvious amid US geopolitical tensions in Venezuela, South America and now Greenland.

Day Ahead – Australia and Eurozone CPI, US data

Australian October inflation came in flat on the month, which was stronger than consensus expected. The November print should be positive, largely down to surging electricity prices. The more important quarterly inflation data is released at the end of the month. There is a solid chance of a rate hike at the early RBA meeting.

For the eurozone inflation data, consensus sees the headline easing one-tenth to 2.0% and core unchanged at 2.4%. Lower services and fuel prices should see some disinflation. The ECB is expected to keep an eye on hotter-than-expected wage growth going forward, otherwise policy and this data should be in a ‘good place’ today and in the coming months, with nothing priced in to European interest rate markets.

US jobs data hots up ahead of Friday’s NFP report. JOLTS and ADP will be watched with private payrolls proxies pointing to a very modest gain for December. An earlier ADP print showed a surprise private‑sector decline of −32k, reinforcing the “gradual cooling” narrative. ‘Indeed’ job postings jumped in December and late November which signal an upbeat JOLTS job openings. December non-manufacturing ISM is forecast to move lower to 52.2 from 52.6. New business is likely to cool further as rising input costs and tariff-induced higher prices hit confidence.

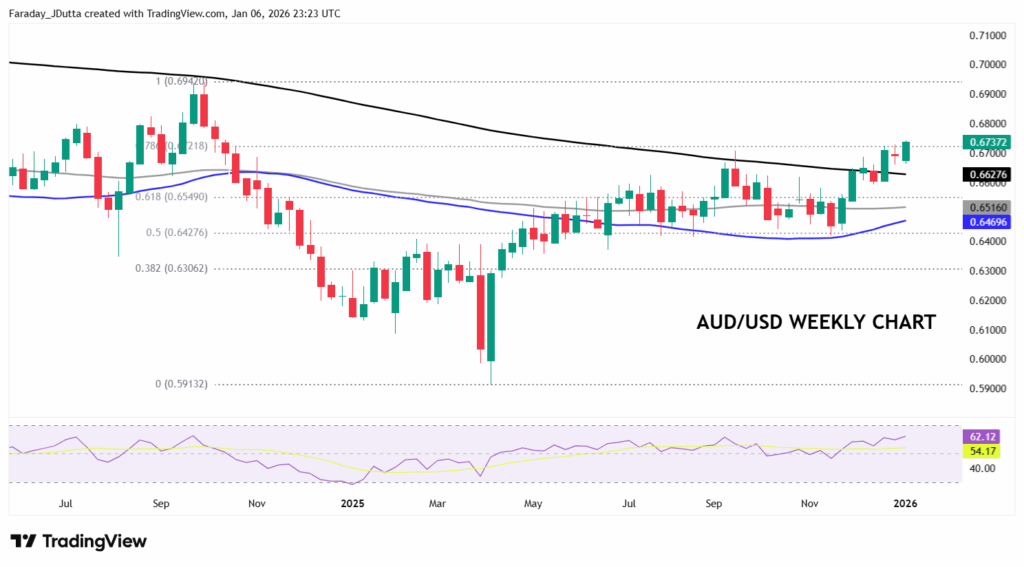

Chart of the Day – AUD break to the upside

AUD was the clear outperformer yesterday, buoyed by strength in metals prices. This tailwind saw AUD/USD hit a peak of 0.6741, a 15-month high last seen in October 2024. Given the support from metals and firm rate expectations, the RBA cash rate will soon be well above the Fed’s for the first time since 2018. These drivers should carry the Aussie firmly beyond the recent high in December, especially if today’s inflation data beats expectations. Given the very recent upside breakout, even a soft print may likely only be a mild setback, unless it is a false break. A minor long-term Fib level from the September 2024 high to April 2025 low is 0.6721. That long-term top sits at 0.6942.