Fed less hawkish than expected: Stocks up, dollar down

* FOMC lowers rates with three dissents, keeps one more cut projection in 2026

* Powell says rate policy well positioned, future of policy not on pre-set course

* USD sinks to 6-week lows, stocks hit 6-week highs

* Bank of Canada holds rates, says economy looks better despite tariffs

FX: USD lost ground immediately after the Fed announcement as it moved away from the 50-day SMA at 99.21. There were two dissenters who wanted no cut, and one who wanted a 50bps cut. The median dot plot predicted one more rate cut next year, and a terminal rate just above 3%, both unchanged from the prior projections and expected ahead of this meeting. A balance sheet adjustment was also announced which added to policy easing. Powell said during his press conference that the move was due to the gradual cooling in the labour market. The dollar fell to 6-week lows as Powell didn’t push back as much against rate cuts as predicted. The 100-day SMA is at 98.62.

EUR advanced above the 100-day SMA at 1.1641. ECB President Lagarde hinted of bullish revisions to the central bank’s forecast at next Thursday’s meeting, where a widely anticipated hold is likely to be paired with a modestly hawkish tone. A growing number of ECB officials have recently shifted their communication from neutral, introducing upside risk to the rate path. Money markets now see a 25bps hike by December 2026 as a coin flip. But French political uncertainty has risen in recent days with budget issues rearing their head once more.

GBP moved higher above the 200-day SMA at 1.3336 after the Fed meeting in what looked like a classic bullish breakout after a continuation pattern. Domestic risk remains limited ahead of Friday’s data. The latest BoE comments have leaned somewhat hawkish, balancing dovish communication earlier this week. MPC member Lombardelli expressed upside risk concerns to inflation. Next Thursday’s meeting sees markets pricing a 92% chance of a 25bps cut, though the terminal rate has lifted in recent days, in line with other major central banks like the RBA and BoC.

JPY halted this week’s losing streak as Treasury yields eased back. Next week’s BoJ meeting sees markets pricing in 23bps of tightening. Quarterly domestic Tankan sentiment figures will also be of interest, scheduled for release early next week.

CAD modestly strengthened after the BoC’s decision to keep rates steady at 2.25%. We got relatively neutral messaging that reinforced the idea that the easing cycle is likely complete, whilst maintaining policy optionality. Still, markets know that central banks rarely stay inactive for too long. A rate hike later next year would be in line with the typical gap between the end of one BoC policy cycle and the start of the next. This contrasts with another possible Fed rate cut as the major slipped to levels last seen in late September.

US stocks: The S&P 500 added 0.67%, closing at 6,887. The Nasdaq moved higher by 0.42% to finish at 25,776. The Dow settled higher by 1.05% at 48,058. Industrials, Materials, Consumer Discretionary and Healthcare led the gainers, while Utilities was the only sector in the red. Risk assets rallied after the net dovish Fed and Powell press conference. Downside risks to employment were highlighted with -20k payrolls per month expected, while inflation has come in a touch higher. Rates are said to be in a plausible range of neutral, with a great deal of data before the January rate decision. There’s a coin toss chance of a rate cut in March, up from around 39% before this meeting. Oracle reported after the close and tumbled more than 11% on disappointing cloud revenue, and soaring Capex which meant funding questions remain.

Asian stocks: Futures are mixed. APAC stocks were mostly muted ahead of the Fed policy decision while the region also digested the latest Chinese inflation data. The ASX 200 was flat as weakness in tech, industrials, energy, health care and financials was offset by gains in miners, materials and resources. The Nikkei 225 initially rallied above 51,000 on recent currency weakness but then reversed course as yields briefly edged higher on BoJ rate hike risks. The Hang Seng and Shanghai Comp retreated following mixed inflation data. Trade-related issue also lingered, including reports that China is set to limit access to Nvidia’s H200 chips despite export approval from US President Trump, and that chips exported to China will undergo a special security review.

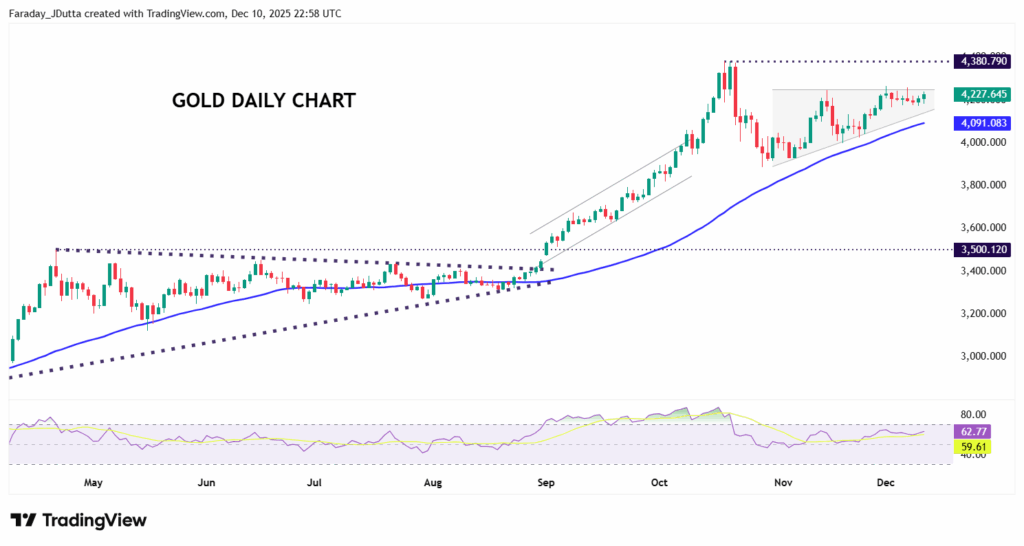

Gold eventually moved higher through the Us session after the less hawkish than expected Fed and Chair Powell press conference. Prices are still stuck in a range since the end of November.

Day Ahead – Australia Jobs, SNB Meeting

Expectations are for the headline Australia jobs print of 20k, after the prior 42k. Unemployment is forecast to reverse some of the strength from October when it dropped two-tenths to 4.3%. The series is typically volatile, and the youth joblessness has moved the data sharply over recent months. At the recent RBA meeting, Governor Michele Bullock seemingly ruled out any further rate cuts and contemplated rate hikes next year should core inflation prove persistent, and the labour market hold up.

The SNB is expected to hold rates at 0%. Inflation and GDP have weakened recently but the bank is likely to predict an inflation pickup and continued growth expansion through next year. That may limit the case for more policy easing.

Chart of the Day – Bullish gold ascending triangle pattern developing?

New Year 2026 year-end forecasts from investment banks are coming in with the latest being from Goldman Sachs. They predict upside to their end-2026 target of $4,900. More broadly, analyst expectations for the new year have shifted decisively higher, with most major institutions now forecasting gold between $4,000 and $5,300 per ounce, and several modelling scenarios materially above that range. Upside is expected to be driven by Fed rate cuts, strong ETF demand and continued central bank buying. Stronger debasement-driven scenarios suggest prices towards $6,000. The flip side to this could be a stronger dollar on less Fed policy easing and fading geopolitical tensions. In the near-term prices have been consolidating and tracking sideways above the 50-day SMA at $4,091. A bullish ascending triangle pattern could be developing. The record top is $4,381.