A stock exchange is a marketplace where buyers and sellers trade financial instruments such as shares, bonds, and other securities. It serves as a central hub for companies to raise capital, and for investors to buy and sell these assets in a regulated environment.

These exchanges play a vital role in global finance, influencing economic growth, investment flows, and the movement of capital worldwide. They connect local and international markets, helping investors access opportunities across regions and sectors.

This article provides an updated overview of the world’s biggest stock exchanges, ranked by market capitalisation. It also explores their role within the broader global stock market and why they matter to traders, investors, and economies.

Key Points

- The largest stock exchanges, such as the New York Stock Exchange, Nasdaq, and Shanghai Stock Exchange, hold trillions in market capitalisation and influence global investment flows.

- Each exchange reflects its regional economy, specialises in certain sectors, and varies in global reach through cross-border listings and trading links.

- Exchange size matters as it indicates liquidity, investor confidence, and the exchange’s role in shaping both regional and global equity markets.

What Is a Stock Exchange?

A stock exchange is a regulated marketplace where shares, bonds, exchange-traded funds (ETFs), and other securities are traded. It provides a structured environment that ensures transparency, efficiency, and adherence to established rules, allowing buyers and sellers to transact with confidence.

These exchanges enable companies to raise capital through initial public offerings (IPOs) and give investors a platform to trade securities in the secondary market. Unlike over-the-counter (OTC) markets, stock exchanges require formal listings and regulatory oversight, helping to standardise trading practices and support investor trust.

Top 10 Largest Stock Exchanges in the World

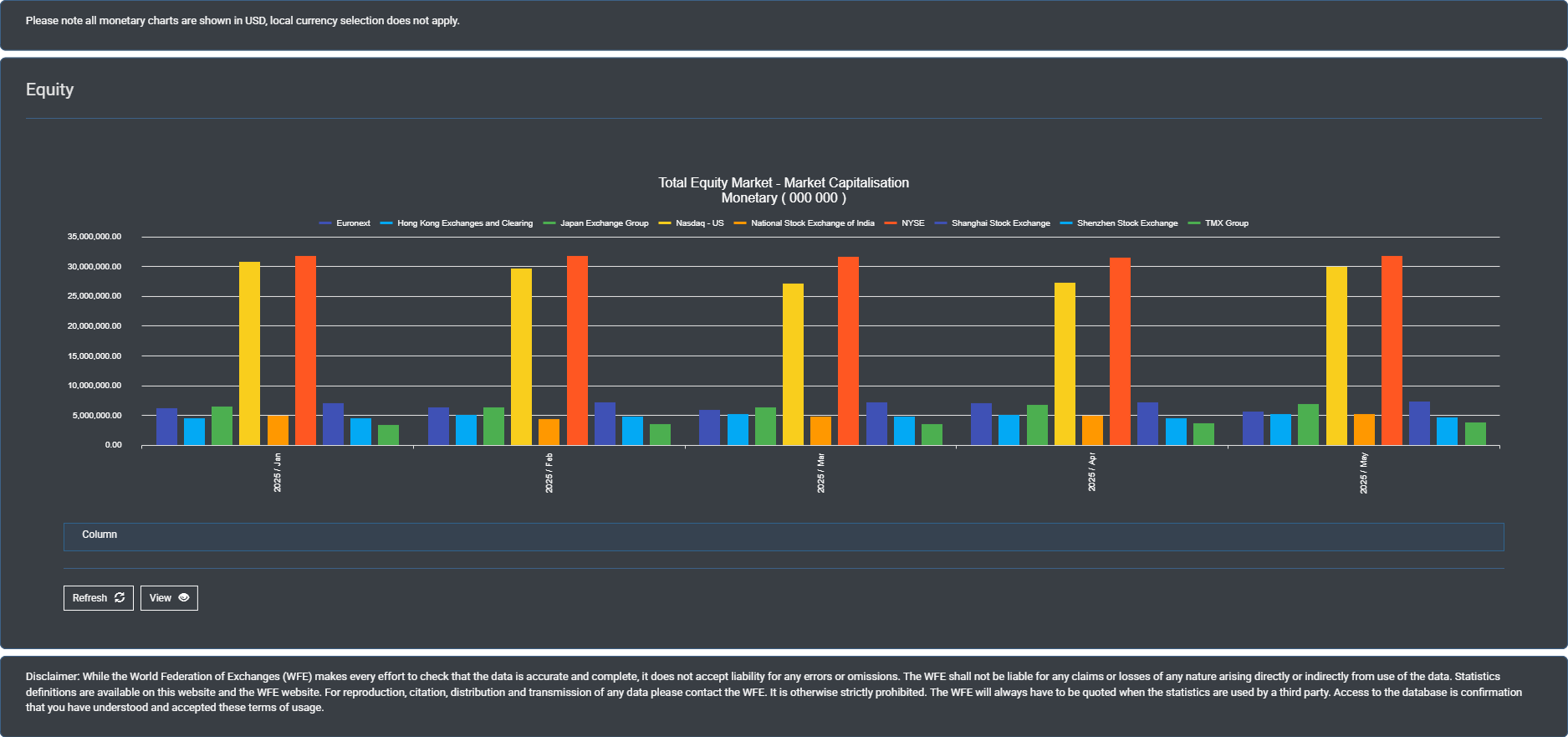

When comparing the size of stock exchanges, the most common benchmark is the market capitalisation of all listed companies. Market capitalisation is calculated by multiplying a company’s share price by its total number of outstanding shares, and then summing this value for all companies on the exchange.

This metric provides a snapshot of the total value of securities traded and reflects the exchange’s overall scale and influence in global financial markets. Here’s a table that summarises the top 10 biggest exchanges.

Top 10 Largest Stock Exchanges by Market Capitalisation (May 2025) [1]:

- New York Stock Exchange (United States) – $31.7 trillion

- Nasdaq (United States) – $29.9 trillion

- Shanghai Stock Exchange (China) – $7.3 trillion

- Japan Exchange Group (Japan) – $6.9 trillion

- Euronext (Europe) – $6.0 trillion

- London Stock Exchange (United Kingdom) – $5.9 trillion

- Hong Kong Exchanges and Clearing (Hong Kong) – $5.2 trillion

- National Stock Exchange of India (India) – $5.2 trillion

- Shenzhen Stock Exchange (China) – $4.6 trillion

- TMX Group (Canada) – $3.8 trillion

1. New York Stock Exchange (NYSE)

Founded in 1792, the New York Stock Exchange (NYSE) in the United States is the largest stock exchange in the world by market capitalisation. As of May 2025, it holds an estimated $31.7 trillion in listed value, representing a significant share of global equity markets.

The NYSE hosts more than 2,300 listed companies across multiple sectors, with many featuring in major indices such as the Dow Jones Industrial Average and the S&P 500.

Notable names include Nvidia, Microsoft and Apple—three of the largest market capitalisation companies in the world [2]. Its size, liquidity, and global influence make it a central hub in the worldwide stock market.

2. NASDAQ

Established in 1971, Nasdaq became the first fully electronic stock exchange, streamlining trading through a technology-driven platform from its inception. By May 2025, its market capitalisation reached approximately $29.9 trillion, making it the second-largest stock exchange globally.

Nasdaq lists over 3,500 companies, many of which are leaders in the technology, biotechnology, and communication sectors. It is home to some of the most influential stocks in the Nasdaq Composite and Nasdaq-100 indices, including Microsoft, Amazon, and Tesla. This strong tech focus has cemented its reputation as a leading exchange in both US and global financial markets.

3. Shanghai Stock Exchange (SSE)

The Shanghai Stock Exchange (SSE), founded in 1990, is one of the two main stock exchanges in mainland China. With a market capitalisation of around $7.3 trillion as of May 2025, it ranks among the largest securities exchanges in the world.

The SSE lists over 2,100 companies, including some of China’s biggest state-owned enterprises and leading financial institutions. Key indices such as the SSE Composite Index and SSE 50 track the performance of major listed firms, including Industrial and Commercial Bank of China (ICBC) and PetroChina.

4. Japan Exchange Group (JPX)

Formed in 2013 through the merger of the Tokyo Stock Exchange and Osaka Securities Exchange, the Japan Exchange Group (JPX) is headquartered in Tokyo. It holds a market capitalisation of approximately $6.9 trillion, making it the largest stock exchange in Japan and a major player in the Asia-Pacific region.

The JPX lists over 3,700 companies and operates well-known indices such as the Nikkei 225 and the TOPIX. Leading companies on the exchange include Toyota Motor Corporation, Sony Group, and Mitsubishi UFJ Financial Group.

5. Euronext

Euronext, established in 2000 through the merger of exchanges in Paris, Amsterdam, and Brussels, is now a pan-European exchange spanning multiple countries. As of May 2025, it has a total market capitalisation of around $6.0 trillion.

With more than 1,900 listed companies, Euronext operates major indices such as the Euronext 100 and CAC 40. Prominent companies include LVMH, Airbus, and TotalEnergies. Its cross-border structure makes it one of the most significant European share market indices providers.

6. London Stock Exchange (LSE)

Founded in 1801, the London Stock Exchange (LSE) is one of the oldest stock markets in the world. As of May 2025, its market capitalisation stands at approximately $5.9 trillion.

The LSE lists over 1,900 companies from more than 60 countries, reflecting its global reach. It is home to the FTSE 100 index, which includes companies such as HSBC Holdings, BP, and Unilever.

7. Hong Kong Exchanges and Clearing (HKEX)

Hong Kong Exchanges and Clearing (HKEX), established in 2000 through a merger of the Stock Exchange of Hong Kong, Hong Kong Futures Exchange, and Hong Kong Securities Clearing Company, has become one of Asia’s leading stock exchanges. By May 2025, it recorded a market capitalisation of about $5.2 trillion.

HKEX lists over 2,500 companies, including many mainland Chinese firms seeking international investors. Its benchmark Hang Seng Index features companies like Tencent Holdings, HSBC Holdings, and China Mobile.

8. National Stock Exchange of India (NSE)

Founded in 1992, the National Stock Exchange of India (NSE) has grown into the country’s largest exchange by market capitalisation, reaching around $5.2 trillion in May 2025.

The NSE lists more than 2,000 companies and operates the NIFTY 50 index, which tracks the performance of major Indian companies such as Reliance Industries, Tata Consultancy Services, and Infosys.

9. Shenzhen Stock Exchange (SZSE)

Established in 1990, the Shenzhen Stock Exchange (SZSE) is one of China’s primary stock exchanges, alongside the Shanghai Stock Exchange. With a market capitalisation of about $4.6 trillion as of May 2025, it plays a significant role in the country’s capital markets.

The SZSE is known for its large number of technology and manufacturing companies, many of which are included in the SZSE Component Index. Key listings include BYD Company, Ping An Insurance, and Vanke.

10. TMX Group

TMX Group, which operates the Toronto Stock Exchange (TSX) and TSX Venture Exchange, is Canada’s largest securities market. Founded in 1852, the TSX has a market capitalisation of roughly $3.8 trillion as of May 2025.

The exchange lists over 1,500 companies, with a strong representation from the energy, mining, and financial sectors. Major names include Royal Bank of Canada, Shopify, and Enbridge.

How Do These Stock Exchanges Differ?

While the largest stock exchanges share a common role as regulated marketplaces for securities trading, each has unique characteristics shaped by its location, market participants, and sector composition. These differences influence how they operate within their regional economies and connect to the global stock market.

Regional Influence

Each exchange is closely tied to the economic health and priorities of its home region. The New York Stock Exchange and Nasdaq in the United States reflect the strength of the US economy, influencing global equity markets through high-value listings and major indices.

In Asia, exchanges such as the Shanghai Stock Exchange, Hong Kong Exchanges and Clearing, and National Stock Exchange of India are indicators of economic growth trends in China, Hong Kong, and India, respectively.

Similarly, Euronext and the London Stock Exchange serve as important benchmarks for European share market indices, reflecting regional economic conditions and policy changes.

Sector Specialisation

Some exchanges are globally recognised for their concentration in specific industries. Nasdaq is synonymous with technology, hosting many of the most influential stocks in the Nasdaq index, such as Apple, Microsoft, and Tesla. Toronto Stock Exchange under TMX Group is well-known for its mining, energy, and natural resource listings, reflecting Canada’s resource-driven economy.

Meanwhile, Shenzhen Stock Exchange has a strong presence of small to mid-cap technology and manufacturing firms, while the London Stock Exchange features a broad mix, including finance, consumer goods, and energy. This sectoral focus often shapes investor interest and the types of companies seeking listings.

Global Reach

The extent of foreign listings varies significantly across exchanges. Hong Kong Exchanges and Clearing is a prime example of a global bridge that attracts mainland Chinese companies seeking international capital and overseas investors looking for exposure in China. Euronext is inherently cross-border, operating in several European countries under a unified market structure.

The New York Stock Exchange and Nasdaq also host many foreign companies that want access to deep US liquidity and investor demand. Cross-listings, international trading links, and dual-listed companies strengthen these exchanges’ roles in the global share market, allowing capital to flow more freely between regions.

Learn more about global stock trading hours and how they differ across major markets.

Why Size Matters in a Stock Exchange

- Represents Total Market Value: Market capitalisation reflects the combined value of all listed companies and measures the exchange’s scale and influence.

- Signals Liquidity: Larger market capitalisation often means higher liquidity, allowing securities to be traded more easily without large price swings.

- Attracts Diverse Investors: High liquidity draws both institutional and retail participants, enabling efficient price discovery and smoother trade execution.

- Indicates Investor Confidence: Exchanges with higher market capitalisation often host financially stable, leading companies, boosting market credibility.

- Acts as an Economic Indicator: Large exchanges can influence regional and global equity markets through their size, trading activity, and international connections.

- Shapes Investor Perception:

a. Large exchanges are often seen as established and globally connected.

b. Smaller exchanges can offer niche or emerging market opportunities.

How Traders Can Gain Exposure to These Exchanges

Traders and investors can access the performance and opportunities of major stock exchanges through a range of investment vehicles, from broad-market funds to direct share purchases.

To gain exposure to stock exchanges, traders can:

- Trade Index Fund CFDs and ETF CFDs – Gain exposure to benchmarks such as the S&P 500, FTSE 100, or Nikkei 225 through Vantage, without owning the underlying assets.

- Trade CFDs on Global Markets – Open a live account to speculate on the price movements of indices, stocks, and ETFs.

- Practise in a Risk-Free Environment – Use a demo account to build familiarity with trading platforms and market conditions before committing real capital.

If you are not ready to start trading, you can explore the financial markets further with Vantage’s Academy. It offers a comprehensive range of free educational articles and courses designed to build market knowledge and awareness.

Frequently Asked Questions (FAQs)

Which Is the Largest Stock Exchange in the World?

The New York Stock Exchange (NYSE) in the United States is the largest stock exchange in the world by market capitalisation, valued at approximately $31.7 trillion as of May 2025.

What Is the Difference Between the NYSE and NASDAQ?

The NYSE operates as a traditional auction market with both physical trading floors and electronic systems, while Nasdaq is fully electronic and known for its concentration of technology-focused listings.

While both are major US stock exchanges, their listing requirements, trading systems, and sector specialisations differ significantly.

Can I Trade on a Foreign Stock Exchange?

Some brokers provide access to international markets. With CFDs, traders can speculate on the price movements of indices, stocks, or ETFs linked to these exchanges, without directly owning the underlying shares.

This allows traders to participate in overseas markets without being physically located in that country. However, it is important to be aware of currency risks, time zone differences, and any additional fees or regulations.

How Often Does Exchange Market Capitalisation Change?

Market capitalisation changes continuously during trading hours as share prices fluctuate. Broader rankings and statistics are typically updated monthly or quarterly by market data providers.

Official rankings and aggregated statistics are often published monthly or quarterly by organisations like the World Federation of Exchanges, but live market data can fluctuate by the second.

Reference

- “The world’s largest stock exchanges: 10 biggest by market capitalization – Bankrate”. https://www.bankrate.com/investing/worlds-largest-stock-exchanges-biggest-by-market-capitalization/ . Accessed 13 August 2025.

- “Largest companies by marketcap – Companiesmarketcap”. https://companiesmarketcap.com/ . Accessed 13 August 2025.