Financial markets often welcome an interest rate cut, with positive headlines and optimism about easier borrowing conditions, breathless headlines about “easing cycles,” and a collective sigh of relief from investors who’ve been waiting for cheaper money to flow.

The logic feels simple enough: lower rates makes borrowing cheaper, spending then goes up, and stocks follow. But here’s the thing. What feels like a “quick fix” can sometimes create a bigger problem than the one it solved.

Think of the Fed’s latest 25-basis-point (25bp) cut in September 2025 [1]. To many, it looked like a green light for markets to move higher. It’s no coincidence that key indices are already pricing in more easing, convinced that the “Fed put” is alive and well. But history tells us a more complicated story.

Too often, the same medicine that stimulates growth has also reignited the very inflation central bankers had worked so hard to tame. From the “stop-and-go” policy mistakes of the 1970s to the demand surge after the COVID-19 stimulus, we’ve seen how “easy money” can sow the seeds of its own undoing.

Here, we’ll look at how easy money can sometimes backfire, the historical lessons that highlight these risks, and why the next chapter of this cycle may present new challenges.

The Double-Edged Nature of Rate Cuts

Think of monetary policy like medicine. At the right dosage, it can heal the economy, reviving credit flows, housing markets, and consumer demand. But too much medicine, or the wrong timing, can create side effects that worsen the underlying disease.

Markets tend to celebrate cuts as a “win” for risk assets, but central bankers know they’re walking a tightrope. Cut too late, and growth falters. Cut too early, though, and you might spark a wave of inflation that resets the whole tightening cycle. Either scenario is bad for markets.

That’s why Powell called the September move a “risk management cut.” Translation: it’s a hedge against slowing growth, not a declaration of victory over inflation. That’s the balancing act – rate cuts are both a lifeline and a liability.

When applied cautiously, cuts can extend expansions, but applied too early or too aggressively, they risk undoing years of progress against inflation. And this isn’t just theory.

The mechanics of how lower rates ripple through the economy explain why the very medicine meant to heal can sometimes worsen the fever. Which brings us to the next challenge: the inflation feedback loop.

The Inflation Feedback Loop

Rate cuts are meant to grease the wheels of the economy by making money cheaper to borrow. Households refinance mortgages, companies take on new loans, and governments issue more debt, all with the goal of spending, investing, and expanding.

But here’s the catch: under certain conditions, this very mechanism can light the fuse for inflation to reignite.

- Demand Running Hot: Lower borrowing costs boost housing, autos, and corporate expansion. That’s great when there’s slack in the system. But once factories are humming and labour markets are tight, extra demand doesn’t create more output. It just pushes prices higher.

- The Currency Effect: Cheaper money often weakens the dollar. That may sound good for exports, but it also makes imports – everything from oil to semiconductors – more expensive. Higher input costs filter through supply chains until consumers end up footing the bill.

- The Expectations Trap: Add in rising wages, and suddenly, businesses feel compelled to raise prices just to protect margins. If consumers then expect prices to keep rising, they demand even higher wages. The result? A self-reinforcing spiral that’s hard to stop once it starts.

In short, easing doesn’t just stimulate growth. It can quietly shift the economy onto an inflationary track and this is track is one that markets often recognise too late.

Market Overreactions and the “Fed Put”

For decades, investors have operated under the assumption of the “Fed Put”. In other words, it’s the belief that the Fed will always step in to protect markets from sharp downturns.

That belief can drive asset prices higher than fundamentals alone justify. Rate cuts are seen as proof. But this has risks:

- Overpricing of Dovish Expectations: Investors often price in multiple rate cuts in advance, pushing up equities, credit, and other assets under the assumption that central banks will maintain an easy policy. If inflation suddenly turns up (or fails to fall as expected), the Fed may need to delay or reverse cuts, or even hike again, catching market participants off guard.

- Asset Price Bubbles & Imbalances: Easy money doesn’t just stimulate productive investment; it may also inflate asset bubbles such as real estate, equities, and commodities, especially when financing costs are low and credit is abundant.

- Credibility & Expectations: If a central bank cuts despite inflation persistence, it risks undermining its credibility. High inflation expectations embedded in consumer and business behaviour can themselves fuel inflation, making the Fed’s job harder.

A recent example is this. After the September 2025 cut, markets widely expected additional easing for the rest of the year. But inflation remains a concern as it is well above the Fed’s target, and recent Fed projections suggest inflation might not return to target for several years.

This mismatch between expectation and reality sets the stage for a possible sharp correction in asset markets, especially if inflation surprises to the upside.

Think of it like driving a car downhill without brakes, trusting that the Fed will build a ramp at the bottom. It works until the ramp isn’t there. That’s the danger of leaning too heavily on the “Fed Put.” Markets may run ahead of themselves, but history reminds us that policy mistakes can carry even bigger costs.

Time and again, well-intentioned easing has backfired, not just through market bubbles but through inflation itself. To understand the stakes today, it is worth looking back at three episodes that highlight how quickly relief can turn into regret.

Historical Lessons: From the 1970s to Post-COVID

We’ve seen this before, and the lessons aren’t pretty.

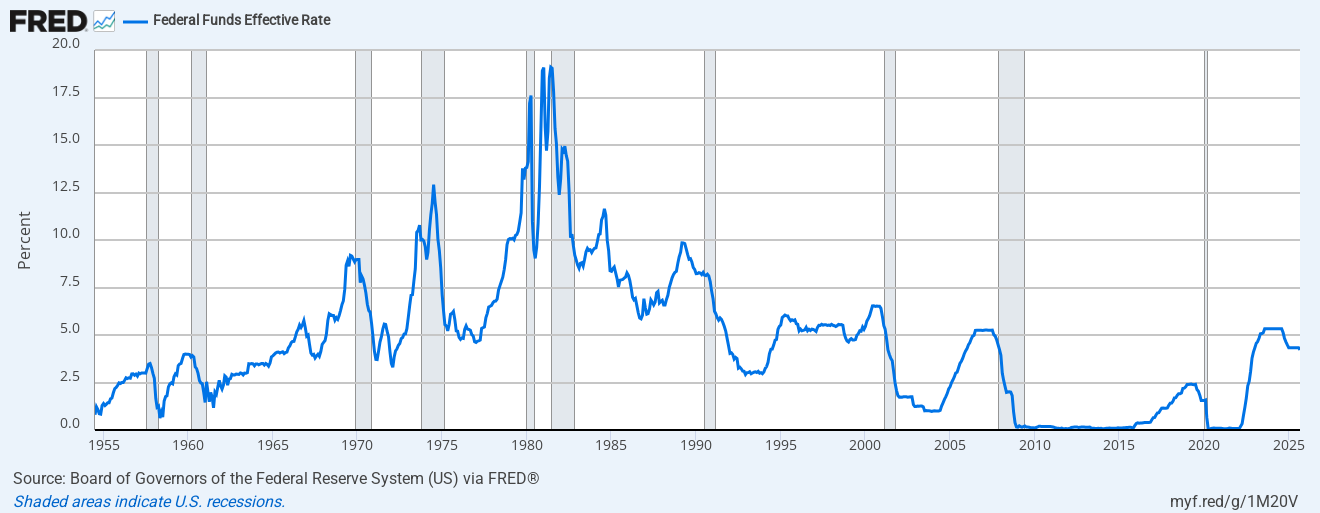

- 1970s Stagflation: Perhaps the most notorious case. Repeated bouts of rate cuts, loose money, and generous fiscal policy fuelled runaway inflation in the US. Once expectations shifted, the Fed found itself trapped. Every attempt to ease made it worse, until Fed Chair Volcker’s brutal rate hikes in the early 1980s finally broke the cycle.

- Late 2000s/Pre-2008 Crisis: After the dot-com bubble burst, aggressive easing kept credit flowing, but it also fed directly into the housing bubble. Cheap mortgages and easy leverage inflated home prices, setting the stage for a collapse that triggered the Global Financial Crisis (GFC).

- Post-Pandemic Easing (2020–2022): In response to COVID-19, governments and central banks opened the floodgates; near-zero rates, stimulus checks, unemployment support, and fiscal firehoses. While these measures prevented depression, they also turbo-charged demand at a time when supply chains were breaking down. The result was obvious in hindsight; inflation surged faster and stuck around longer than many had anticipated.

Each episode underscores the same point. Well-intentioned cuts can produce unintended inflationary outcomes. Easing can buy time, but it can also plant the seeds of bigger problems down the road.

Implications for Global Markets

If easy money does spark renewed inflation, the ripple effects will likely cross borders:

- Commodities: Inflation tends to boost commodity prices (energy, metals, food), especially when demand is strong. Higher commodity prices feed back into inflation (cost-push). Countries that import a lot of raw materials suffer more.

- Emerging Markets: Many EM economies are more vulnerable. A weaker dollar may help, but if inflation picks up globally, pressures on wages, on import costs, on debt servicing (especially if debts are in foreign currency) can weigh heavily although more robust current account balances in most EMs should help offset this.

- Exchange Rates and Trade Balances: A cycle of easing in the US might weaken the dollar. But if inflation comes back, interest rate differentials could flip again. Currency risk becomes a concern.

- Type of Inflation Matters: Is it demand-driven, or cost-push (e.g. energy, tariffs)? For example, an energy shock or supply disruption will push up costs regardless of policy; easing in that context can magnify the inflationary shock. Conversely, if inflation is demand-side, rate cuts or delayed tightening can be more acutely problematic.

- Policy Constraints Abroad: Central banks in other countries may feel pressured to ease if global growth seems weak. But if inflation is imported (via commodities or global supply chain issues), those central banks may find themselves needing to tighten even as domestic pressures to ease grow.

This suggests that not all markets may respond in the same way. While US equities might face pressure, commodity-exporting economies or resource-heavy firms could experience different effects.

Conclusion: Questioning the Consensus

The easy narrative says: “Rate cuts = good news.” But history tells a harder truth. While cuts can cushion downturns, they also risk reawakening inflation, unsettling expectations, and forcing central banks into painful reversals.

Today’s environment may look more forgiving, long-term inflation expectations are better anchored, supply bottlenecks are easing, and the Fed is more cautious in its communication.

Still, none of this eliminates the risk. All it takes is an oil shock, a geopolitical flare-up, or shifting consumer psychology to turn easing from a safety net into an accelerant.

The key takeaway is that policy support should not automatically be viewed as a guarantee of lasting market strength. Rate cuts can boost markets in the short run, but they also carry hidden costs. The challenge in this cycle is to balance optimism with vigilance because easy money (in any form) often comes with strings attached.

Reference

- “Fed approves quarter-point interest rate cut and sees two more coming this year – CNBC”. https://www.cnbc.com/2025/09/17/fed-rate-decision-september-2025.html . Accessed 24 Sept 2025.