Did you know that the time of day you trade can impact your success in foreign exchange (forex) trading? Understanding forex trading sessions is crucial, as these specific periods correspond to when trading activities of financial centres are more active, increasing market volatility and liquidity.

Since forex trading involves exchanging one currency for another, and exchange rates fluctuate over time, traders use these fluctuations to potentially capture profits in the forex markets (To understand more about forex trading, do read our forex beginners guide).

So, what does this mean for you? You need to take advantage of the key trading session times when profit opportunities are highest. This is because the potential for profitable trades decreases outside these time periods. This is a unique feature of the forex market.

Now, let’s dive into exactly what forex trading sessions are and how they impact your trading.

Key Points

- Forex trading sessions are specific periods during the day when trading activity is heightened due to the operations of major financial centres around the world, leading to increased market volatility and liquidity.

- The most significant forex trading overlaps occur during the New York and London sessions, where about 70% of all forex trades happen, offering the highest liquidity and trading opportunities.

- Optimal times for trading specific currency pairs are during their respective major market sessions, which align with the business hours of their primary financial centres, ensuring high market activity and liquidity.

Understanding Forex Market Hours

As mentioned, forex trading sessions are crucial to pay attention to. While the forex market is open 24 hours on weekdays, trading activity typically peaks during specific times when major financial centres around the world are active.

Here’s why that matters:

The trading activity of banks and corporations — the real market movers — increases volatility and liquidity, which attracts more forex speculators. This is because volatility creates opportunities for profits (or losses).

When you trade forex, you’re betting on one currency strengthening against another by taking long (buy) or short (sell) positions. If the market moves in your favour, you make a profit. The bigger the market movement, the bigger the profit (or loss if the market moves against you).

So, how can this help you in your trading?

- You can profit when the forex market is rising or falling.

- Avoid trading when the markets are flat, as limited movement makes it difficult to find profitable opportunities.

Here’s the key takeaway:

Traders should pay attention to the peak forex market sessions when financial centres are active. Timing your trades during these optimal trading session times can help you take advantage of the most profitable opportunities in the forex market.

Global Forex Market Sessions [1]

The global forex market can be split up into four major trading sessions, according to the market hours of four of the world’s most important financial centres: Sydney, Tokyo, London and New York sessions.

Out of these, there are traditionally three peak forex trading sessions:

- Asian (Tokyo) Session

- European (London) Session

- North American (U.S.) Session

This is commonly referred to as the Forex 3-session System.

Opening and Closing Times of Major Forex Market Sessions Around the World [2]

| Session | Local time | UTC |

| Sydney | 7 am to 4 pm | 9 pm to 6 am |

| Tokyo | 9 am to 6 pm | 12 am to 9 am |

| London | 8 am to 5 pm | 7 am to 4 pm |

| New York | 8 am to 5 pm | 1 pm to 10 pm |

As you can see, forex market sessions are not fixed around the world. Each region’s market opening and closing times are based on local business hours, which can vary depending on customs and events, like major holidays.

Keep in mind that markets are closed on Christmas and New Year’s Day, so trading will be paused during these times.

Daylight Saving Time and Forex Trading Sessions

Forex trading sessions can be affected by Daylight Saving Time (DST), which happens twice a year — in March/April and October/November. DST is the practice of moving the clocks forward one hour from standard time in the warmer months and backwards in the fall to maximize natural daylight. During these periods, forex markets in regions such as Europe, the U.S., New Zealand, and Sydney will open and close at times different from usual.

Keep in mind: The UTC times shown in the chart above don’t account for DST. To make it easier, it’s best to use local times as your reference when figuring out the trading hours in your own time zone.

For added convenience, using an online time zone converter can help you accurately match the forex trading sessions to your local time.

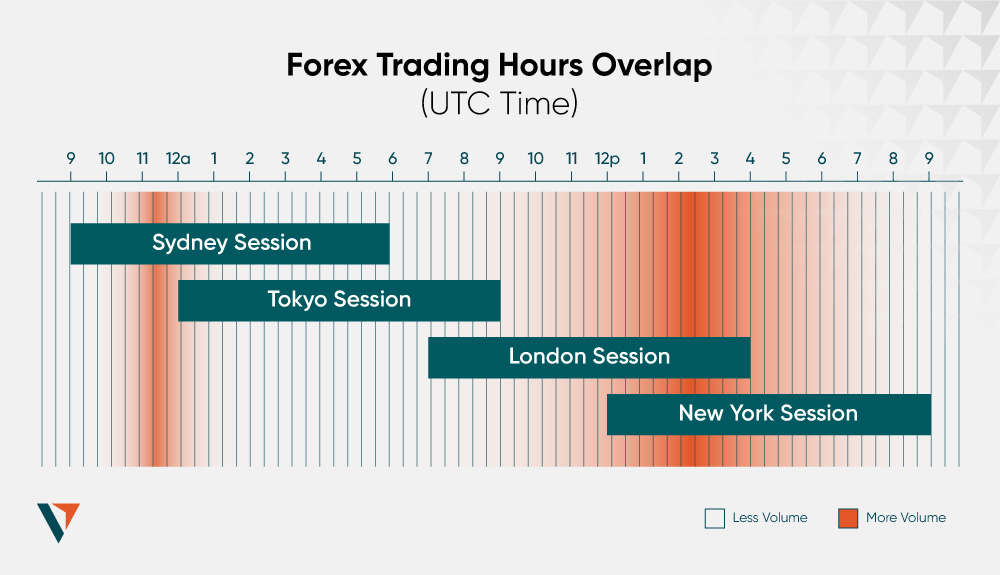

Trading Session Overlaps [3]

You may have also noticed that there are overlaps among the three peak trading sessions, happening on a daily basis.

The following graphic will help you visualise these overlaps.

Trading session overlaps are considered prime forex trading sessions. When two forex markets are active at the same time, trading activity tends to shift into overdrive, resulting in greater price movements, higher trade volumes and increased liquidity.

Let’s take a closer look at the characteristics of the three forex trading session overlaps.

New York and London overlap (1 PM to 4 PM UTC)

The overlap between the New York and London forex trading sessions is the most significant, usually showing the highest volatility and liquidity. During this period, over 70% of all forex trades occur due to the popularity of the USD and EUR, two of the most commonly traded currencies.

As a result, this overlap is the most popular trading time for forex traders, especially those focusing on currency pairs like USD/EUR or EUR/GBP.

Sydney and Tokyo overlap (12 AM to 6 AM UTC)

The Sydney/Tokyo forex session overlap tends to be less volatile than the London/New York overlap, but it still presents solid trading opportunities. If you’re trading EUR/JPY, this time period is particularly important, as this currency pair is most affected by the Sydney/Tokyo overlap.

London and Tokyo overlap (7 AM to 9 AM UTC)

This is the shortest and least active overlap, typically due to the odd hours and low likelihood of significant fluctuations within the 2-hour window.

Trading Strategies for Overlap Hours

As mentioned earlier, session overlap hours are a prime time for forex traders because of the increased volatility and liquidity. During these periods, forex trading activity picks up pace, pushing traders to implement short-term strategies to take advantage of the market’s movements.

Let’s take a look at some short-term forex trading strategies.

Day trading

In this strategy, forex positions are held for a few hours to less than a day — but never overnight. This helps avoid overnight risk, where unexpected events could cause a price gap while the markets are closed.

It’s crucial to maintain discipline to minimize the risk of emotional trading, which can lead to costly mistakes.

Breakout trading

Breakout trading looks for opportunities just before a price “breaks out” from a range it’s been trading within. The goal is to enter the market just before the breakout and continue riding the trade until the market settles.

This strategy works well during session overlaps when market volatility is high. However, breakout trading requires skill and experience to correctly identify breakouts, and beginners may find it challenging to succeed with this approach at first.

Practise Risk Management

Due to the higher volatility during overlap sessions, the forex markets offer more potential for profit. However, the price swings can also lead to larger losses if the market moves against you.

Currency prices typically fluctuate in small quantities. This makes leverage appealing for use in forex because it can multiply trading outcomes, both profits and losses.

The bottom line? When trading during overlap sessions, proper risk management is key.

Here’s what to do: stick to a solid trading plan, choose your strategies wisely, manage your trade sizes, and always follow your predefined limits and rules to avoid costly mistakes.

Best times to trade forex

During High Liquidity

Liquidity refers to how easily a currency pair can be bought or sold without causing significant price fluctuations. It reflects the depth and availability of market participants, and how quickly they can execute trades at competitive prices.

What are competitive prices? It’s the price closest to the perceived value of the asset being traded. For example, if a stock is perceived to be worth USD 100 and is easily sold at that price, we can say the market has perfect liquidity.

When liquidity is high, trades happen more quickly and at prices that closely reflect the current market value. On the flip side, low liquidity means fewer traders and higher chances of slippage (execution price differs from the expected price).

Why does this matter?

When liquidity is low, executing trades becomes more difficult, and slippage can turn a trade from a break-even into a loss. This is why forex traders prefer to trade during periods of high liquidity for their currency pairs.

The New York/London trading session is known for having the highest liquidity. During this overlap, bid-ask spreads are tighter, and the risk of slippage is reduced, making it a prime time for many traders.

Currency-specific Best Times

The forex market is the largest financial market in the world, with a daily trading volume exceeding USD 6.6 trillion, according to the 2019 Triennial Central Bank Survey of FX and OTC derivatives market.[4] This immense size leads to high trading activity and deep market liquidity during the active sessions for major currencies.

Generally, currencies are most active during their respective trading sessions. For example, Yen is most active during the Tokyo session, making currency pairs that include Yen ideal for trading during this time.

It is noteworthy that while the New York/London overlap has peak trading activity, the U.S. and European forex sessions remain highly active outside this overlap.

Here’s the breakdown of the best times to trade specific currency pairs:

| Forex session | Timing (UTC) | Most active currencies | Examples of currency pairs to trade |

| Asian | 12 am to 9 am | JPY, AUD, NZD | JPY/USD, JPY/AUD, AUD/USD, AUD/EUR |

| European | 7 am to 4 pm | GBP, EUR, CHF | GBP/USD, EUR/CHF, USD/CHF, GBP/JPY |

| North American | 12nn to 9 pm | USD, CAD | EUR/USD, USD/CAD, EUR/CAD |

During News Releases

Forex trading can also be greatly impacted by economic news.

Here’s how it works: major news announcements can quickly change currency values, especially when the news differs from expectations. For example, when economic results are released that go against what traders anticipated, currencies can rise or fall rapidly, creating potential trade opportunities.

So, how can you benefit from this?

News trading presents an opportunity to capitalize on these price swings. Positive news about economic growth can strengthen a currency, creating opportunities to go long on that pair. Conversely, negative news can weaken a currency, providing a chance to go short.

Some key news events to watch out for include:

- Central bank interest rate announcements

- Inflation data, such as the Consumer Price Index

- Trade deficits, which translate to more cross-border capital flows, impact exchange rates

- Consumer confidence and consumption level

- Gross Domestic Product

- Unemployment rates, as high unemployment can drag down economic growth, leading to a weaker currency

Pro Tip: Keep an eye on the economic calendar and filter out irrelevant daily news to focus on the reports that affect your currency pairs. For a deeper dive, read our article on ‘News Trading: A Deep Dive into “Buy the Rumour, Sell the News.”’

Conclusion

Understanding trading sessions is crucial for success in forex trading, as it allows you to capitalize on periods of high market liquidity and activity — both of which are essential for executing your trades with minimal disruption.

The good news? Choosing the right trading session time is fairly straightforward. Most traders perform well by simply focusing on the peak trading sessions.

Keep in mind that while the New York/London forex session overlap is known for having the highest activity and deepest liquidity, this also means higher volatility. This heightened volatility may not suit every trader, and you might prefer to trade during more sedate periods when the market is calmer.

Regardless, knowing the major forex sessions and understanding which currency pairs to trade during each session should be fundamental knowledge for any trader. As you gain more experience and improve your skills, this understanding will become increasingly useful in refining your trading strategy.

Frequently Asked Questions (FAQ)

Q. What’s the forex market open timing?

The global forex markets operate 24 hours a day, five days a week. There are four major forex trading sessions:

- Sydney: 9 pm to 6 am UTC

- Tokyo: 12 am to 9 am UTC

- London: 7 am to 4 pm UTC

- New York: 1 pm to 10 pm UTC

Q. What time is the forex market most active?

The forex market experiences the highest activity and deepest liquidity when the London and New York sessions overlap, which occurs from 1 pm to 4 pm UTC. During this period, around 70% of all forex trades take place.

Q. When is the London session in forex?

The London session runs during business hours on weekdays. In local time, the London forex market is active from 8 am to 5 pm, which translates to 7 am to 4 pm UTC.

References

- “The Forex 3-Session System – Investopedia”. https://www.investopedia.com/articles/forex/08/3-market-system.asp. Accessed 22 April 2024.

- “Forex Trading Sessions – BabyPips”. https://www.babypips.com/learn/forex/forex-trading-sessions. Accessed 22 April 2024.

- “The Best Times to Trade the Forex Markets – Investopedia”. https://www.investopedia.com/articles/forex/08/forex-trading-schedule-trading-times.asp. Accessed 22 April 2024.

- “Forex Market: Who Trades Currencies and Why – Investopedia”. https://www.investopedia.com/articles/forex/11/who-trades-forex-and-why.asp. Accessed 22 April 2024.