Equity rally pauses in relatively quiet trade

* US stock rally pauses as Nvidia slides, Fed caution

* Dollar holds steady as investors weigh more Fedspeak and Powell

* Gold powers to another record high, though closes off its peak

* Fed Chair Powell describes rates as ‘modestly restrictive’

FX: USD eased for a second day this week. Fed Chair Powell repeated talk that a softer labour market moved the Fed to shift its balance of risks, which warranted a rate cut last week. Tariff impact was noted to have so far been on the lower range of expectations. PMI data was more or less in line so saw a muted market reaction.

EUR moved higher for a second straight day closing above 1.18. PMIs were mixed with services higher and manufacturing lower than forecast, with the latter dipping back into contractionary territory below 50. We note options market remains bullish with a sizeable premium for protection against EUR strength. The multi-year top is 1.1918.

GBP ticked higher after initially poor PMI numbers. All three metrics fell short of estimates with the services and composite prints remaining in expansionary territory but below the bottom end of analyst expectations. Manufacturing slid further into contractionary mode. The S&P said weakening growth, slumping overseas trade, worsening business confidence and further steep job losses were all seen. We had hawkish comments from BoE Chief Economist Pill as he said there was a need to maintain restrictive policy. The 50-day SMA sits at 1.3467.

JPY traded around its 50-day SMA at 147.66 but modestly outperformed its peers. The LDP leadership race is now front and centre after last week’s hawkish BoJ and near-term dovish Fed. The two candidates are strikingly different with Takaichi seen as a fiscal and monetary dove. Japanese traders were away on the Autumnal Equinox holiday.

AUD printed a doji denoting some consolidation after last week’s aggressive sell-off. The major had moved lower initially on disappointing PMI data, moving down from a multi-year top though it remained above 50 in expansionary territory. CAD underperformed again with US rate differentials widening so keeping the tone defensive.

US stocks: The S&P 500 lost 0.55% to close at 6,656. The Nasdaq settled lower by 0.73% to settle at 24,580. The Dow Jones finished at 46,292, down 0.19%. Consumer Discretionary and Tech got hit with Nvidia down 2.82% and Amazon lower by 3.04%. The former saw investors question the $100bn OpenAI investment around the deal structure and energy demands. Boeing climbed 2% on an $8bn order from Uzbekistan Airways. Energy was the standout sector with five sectors in the green.

Asian stocks: Futures are mixed. Stocks traded mixed too as markets failed to benefit from record highs on Wall Street. Japan was out due to the Autumnal Equinox holiday. The ASX 200 edged higher with gold miners helping, though weak PMIs were a drag. The Hang Seng and Shanghai comp slid after the Trump-Xi call underwhelmed some more while Hong Kong braced for the super typhoon.

Gold jumped to a new peak at $3,791 as bullion got even more overbought. The rally should see a correction at some point, with gains of almost 9% this month. Bugs have been backed by strong ETF demand amid lower funding costs, and a range of the now usual uncertainties, including Fed independence, geopolitical risks, and US fiscal debt concern.

Day Ahead – Australia CPI

August monthly inflation is expected to rise one-tenth higher to 2.9%. Base effects may cause an upside surprise, though prior high electricity costs should reverse in this data. They caused an upside surprise in the July figures, at 2.8% y/y, but economists reckon these costs are set to ease as rebates are applied, which should partially offset further increases elsewhere.

Markets price in the likelihood of one more RBA rate cut, in November or possibly December. A drop in the unemployment rate to 4.2% plus stronger than expected GDP and wage growth for Q2 have supported a pullback in more rate reductions recently.

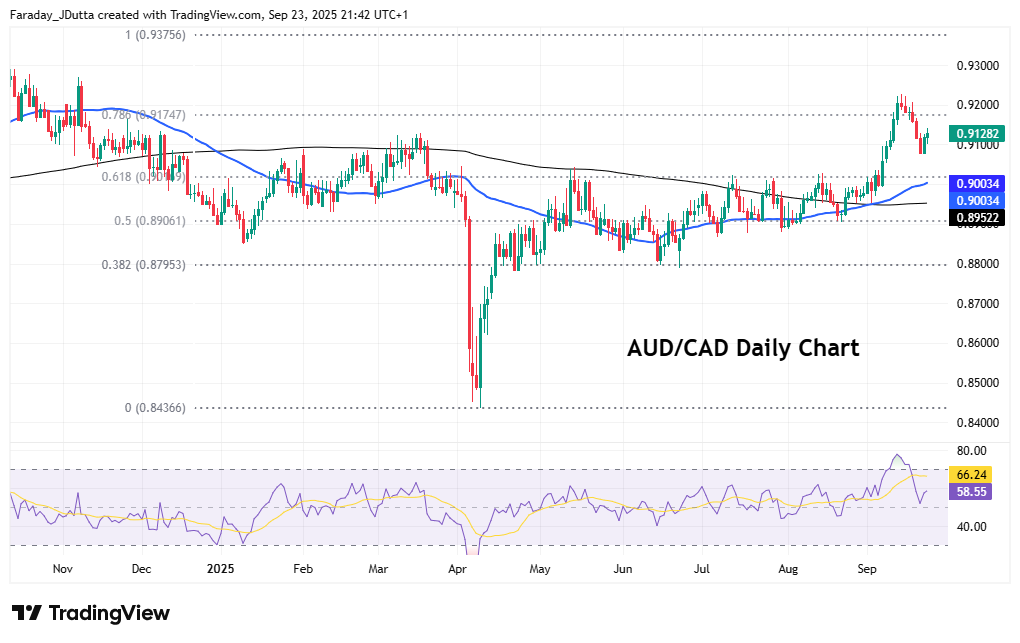

Chart of the Day – AUD/CAD upside break pulls back

The loonie is the weakest major this month as the deterioration in the labour market due to trade uncertainty threatens more BoC rate cuts. In contrast, more RBA policy easing is not guaranteed at all. Gains in AUD/CAD recently extended above the top of the range that had been in place since May. After a prolonged period of range trading, the jump in the daily DMI suggested a more dynamic phase of price action may develop from here. The bullish move out of the range trade broke through a major Fib retracement level (61.8%) of the October 2024 to April 2025 move lower at 0.9017. But prices have fallen back after finding resistance at the minor Fib (78.6%) at 0.9174. Prices have kept above the breakout level and found support around the 21-day SMA so still look bullish.