Gold soars, stocks ever higher ahead of Powell

* Wall Street, amid doldrums, drifts to record closing highs

* Dollar weakness as markets digest Fed speeches

* Gold prices surge to new record with rate cut bets eyed

* Xi, Trump frame phone call in positive terms, but offer few details

FX: USD dipped to the start the week – the one after the important FOMC rate cut and subsequent mixed messaging. After higher growth, stronger inflation and lower unemployment forecasts from officials, markets are now somewhat data dependent, with the emphasis on the labour market. We have a plethora of Fedspeak this week and yesterday saw Miran predicably uber-dovish with his belief that the Fed funds rate is in th emid-2% area. On the flip side, Musalem said he sees limited room for further easing and Hammack confirmed she’s on the higher end of estimates of the neutral rate. Fed Chair speaks later today on the economic outlook.

EUR was nip and tuck for most of the day with the pound for strongest major versus the dollar. ECB comments over the weekend came from some of the doves while there was little follow through from a French Morningstar downgrade or Fitch Italy upgrade. PMI data is the focus today – see below for more.

GBP led the gainers after three days of strong selling. Last week’s awful public sector borrowing data for August, and potential bigger fiscal black hole boosted the bears. But prices have found support at the 50-day SMA at 1.3464.

JPY steadied below the 200-day SMA at 148.52 and on the 50-day SMA at 147.66. Focus is shifting from last week’s relatively hawkish BoJ meeting to the LDP leadership election as the 12-day official campaign period began ahead of the October 4 vote. Dovish candidate Takaichi is leading the two-horse race at the moment.

AUD tried to steady after a sharp three-day sell-off. There was little reaction to RBA Bullock’s balanced comments, in which she highlighted uncertainty, but scope for rate changes if there was a global downturn. CAD underperformed with crude oil softer.

US stocks: The S&P 500 gained 0.44% to close at 6,693, the 28th record finish of 2025. The intraday top was 6,698. The benchmark index is up 18.04% since the Liberation Day low on April 8. The Nasdaq added 0.55% to settle at 24,761, a fresh all-time top. The Dow Jones finished at 46,381, up 0.14% and also a record high close. Only four out of 11 sectors were positive with Tech leading the way +1.74%. Utilities, Industrials and Real Estate were the only other sectors in the green. Nvidia jumped 3.93% as a strategic partnership was announced between it and OpenAI. The deal will see the giant chipmaker invest up to $100bn in OpenAI. The news boosted semiconductors and the tech sector. Apple was also well bid (+4.31%) and closed below the record high at $260.10. Early signs of strong demand for the new, cheaper iPhone 17, and a favourable broker price target raise helped the stock. That said, Communications was the clear laggard amid lacklustre trade in Alphabet (-0.9%) and Meta (-1.7%).

Asian stocks: Futures are mixed. Stocks traded mixed too as markets failed to benefit from the Trump-Xi talks on Friday. The ASX 200 was helped by mining and gold stocks which offset weakness in energy. The Nikkei 225 advanced after Friday’s sell-off, on a softer yen and the BoJ’s decision to sell ETF and J-REITs which was seen as having only a mild market impact. The Hang Seng and Shanghai comp initially bucked the trend and failed to benefit from the “productive” Trump-Xi call, although the mainland later eked out mild gains.

Gold jumped to fresh highs at $3,748 and has already set more than 30 nominal records so far this year. Bullion closed notably strongly. As we recently said, this latest surge has meant it has also topped the inflation adjusted peak set in 1980.

Day Ahead –PMI data

PMI figures tell investors about the health of business activity. A figure above 50 is in expansionary territory, while below is in contractionary land. September eurozone manufacturing is predicted to tick higher to 51.0 from 50.7. Services are seen unchanged at 50.5. Both gauges are sitting in expansionary territory, but growth is weak. The data should also provide more clarity on the impact of US tariffs, following a mixed picture from recent data. If consensus estimates are confirmed, the picture would align with the ECB’s relatively optimistic economic outlook, after it left rates steady at 2% in September.

UK flash PMI follows the latest BoE decision to leave rates steady. Companies’ concerns about the prospect of tax rises and the highest inflation among advanced economies should remain, even though services grew by the most in over a year in August. Manufacturing is expected to slide to 46.9 from 47.0 due to fragile demand, while services is forecast to drop to 53.9 from 54.2. The rate of expansion in the most recent composite hit a one-year high as growth picked up over the summer.

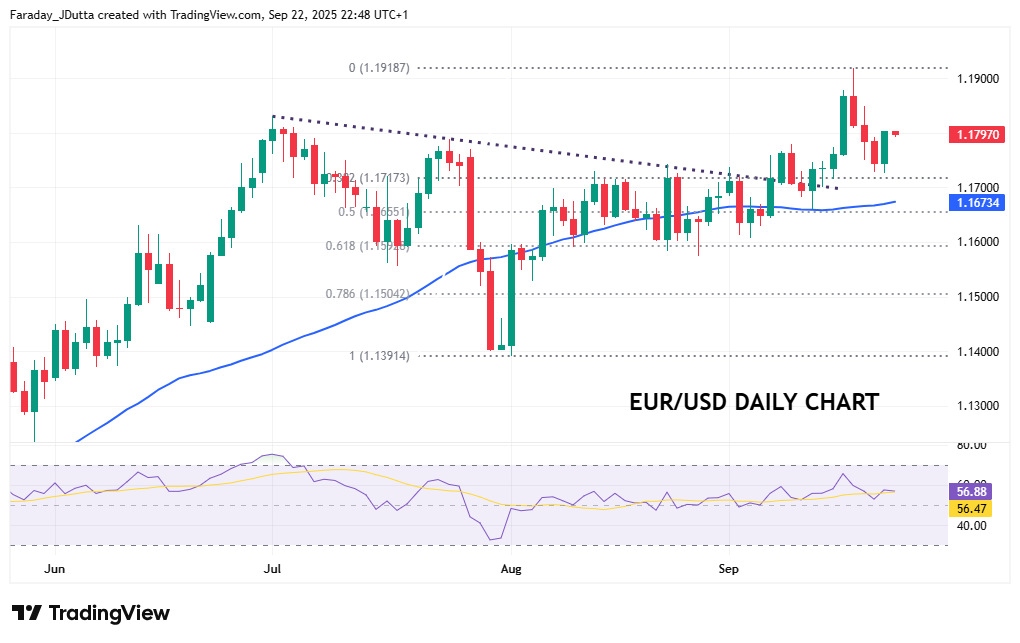

Chart of the Day – EUR/USD close to multi-year highs

Fading ECB rate cut bets have underpinned support for the euro with yield spreads between Germany and the US consolidating recent gains. President Lagarde said recently at the ECB meeting that policy was again in a ‘good place’ and the on hold messaging for an extended period contrast sharply with the Fed. They signalled two more 25bps rate cuts at the remaining FOMC meetings next month and in December, though markets price in slightly less (42bps). Support sits around a short-term Fib level (38.2%) of the August to September move higher at 1.1717. The broken resistance trendline from the July highs is just below. Last week’s multi-year top at 1.1918 remains in sight, with the July top initial resistance at 1.1830.