Tech leads stocks higher, dollar up on Powell push back

* Wall Street indices notch more record high closes as Intel soars

* Dollar recovery continues as Fed fails to meet dovish expectations

* BoE keeps base rate unchanged, balance sheet reduction on track

* Bank of Japan expected to keep rates steady amid political upheaval

FX: USD was top of the major currency pile and rebounded for a second day after printing multi-year lows straight after the release of Wednesday’s FOMC statement. Markets continued to digest a more hawkish than expected Chair Powell and economic projections. They showed stronger growth, lower unemployment and higher inflation, which are more a recipe for a rate hike. In addition, there was a greater dispersion of views, as the dot plots had nine out of 19 officials calling for a maximum of one more cut this year, and the remaining 10 for at least two 25bps cuts. That said, there are 47bps of cuts priced in for this year, with 22bps for the next meeting in October. Weekly initial jobless claims fell by the most in nearly four years, easing some worries about labour market weakness. The 50-day SMA on the Dollar Index sits at 98.08.

EUR outperformed most of its peers but fell for a second day versus the dollar. There was little specific eurozone news. French domestic political tensions continue to linger with 10-year French government bons yields now trading above their Italian peers. The late July high offered initial support around 1.1788. The 50-day SMA sits at 1.1665.

GBP fell more than 0.5% after the expected BoE decision to keep rates on hold and a 7-2 vote split. The bank repeated its ‘cautious and gradual’ guidance with rate cuts hamstrung currently by sticky, elevated inflation. There’s around 45bps of rate cuts priced in by the end of next year, with bets on this year steady. A November rate reduction will need much softer service inflation which seems unlikely at this stage.

JPY moved back up into the multi-week range ahead of the BoJ meeting which could herald a hawkish hold. Disappointing machinery orders didn’t help the yen. Takaichi entered the LDP leadership contest and worries about her pro-fiscal/monetary policy views weighed as well. The 200-day SMA is at 148.60.

AUD traded defensively again with jobs data falling. NZD was the notable major underperformer following weak Q2 GDP which showed the economy contracted by 0.6% y/y versus the expected flat print. This resulted in money markets fully pricing in a cut at the RBNZ meeting in October, with a small chance of an oversized 50bps move. CAD was the best performer against the dollar, closing marginally softer. BoC rate bets remain dovish, but markets are softening the extent of easing, with around 21bps of cuts priced in by December.

US stocks: The S&P 500 gained 0.48% to close at 6,631, the 26th record finish of 2025. The intraday top was 6,656. The Nasdaq jumped by 0.95% to settle at 24,454, a fresh all-time top but off its intraday peak at 24,554. The Dow Jones finished at 46,142, up 0.27% and also a record high. The small cap Russell 2000 closed up 2.5% at its first record closing high since late 2021. Seven sectors out of 11 were positive with Tech leading the way as the semiconductor index made more record highs. Nvidia jumped 3.5% and Intel surged 22.8% on the day after they announced a deal with the former set to take a $5bn stake in the latter, which comes after the Trump administration’s 10% stake. Defensives like Consumer Staples lagged.

Asian stocks: Futures are in the green. Stocks traded choppy during the FOMC with conflicting signals about jobs, inflation, growth and the dot plot. The ASX 200 slid with the energy dragging. The Nikkei 225 shot higher to another record high with yen weakness helping and ahead of the BoJ rate decision. The Hang Seng and Shanghai comp were mixed as Baidu surged +15.7% after an Arete upgrade tied to its AI chip venture.

Gold moved lower for a second straight day, something we last saw four weeks ago. Conditions were heavily overbought and due a correction. Treasury yields and the dollar have risen since the mildly hawkish Fed meeting.

Day Ahead –Bank of Japan meeting

The Bank of Japan is expected to maintain its 0.5% policy rate as it assesses the impact of the US-Japan trade deal and the fluid domestic political situation. The latter is uncertain with the potential for looser monetary and fiscal conditions if Takaichi wins. That would mean the yen gets sold as BoJ policy normalisation and rate hikes get pushed back, so eyes are on opinion polls up to voting day on 4 October. The announcement that reformer Koizumi was running briefly helped the yen earlier in the week.

Headline Japanese inflation is released just before the BoJ decision and is forecast to ease to 2.9% y/y in August due to last year’s high base, while core inflation is predicted to stay above 3%. An upside surprise may see a ‘hawkish hold’ from the BoJ, which paves the way for a rate hike in October or November.

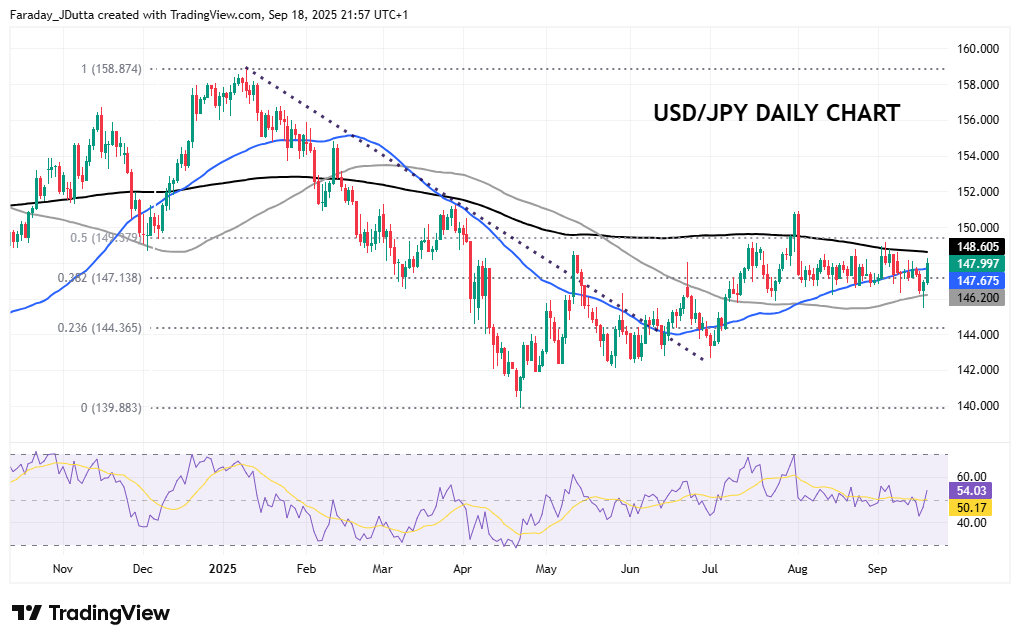

Chart of the Day – USD/JPY stuck in a range

This pair has historically been relatively volatile but over the last few months at least, prices have been stuck trading sideways between roughly 146.50 and 148.75. The upside has been capped by the 200-day SMA, curently at 148.60, and the midpoint of this year’s move lower at 149.37, while the major has traded around 50-day SMA at 147.67 and a major Fib (38.2%) of that decline at 147.13 over the past few weeks. A breakdown during the FOMC meeting yesterday was false with the 100-day SMA acting as support at 146.20.