特朗普的关税计划下周可能会继续引发市场关注。由于对特朗普下一步行动的担忧和不确定性,交易员可能会忽略下周的两项关键数据——美国消费者物价指数 (CPI) 和联邦公开市场委员会 (FOMC) 会议纪要。然而,请保持警惕,保持关注,因为在当前的混乱局面中,FOMC 会议纪要和 CPI 仍有可能推动市场发生重大波动。

CPI 和 FOMC:不容忽视的市场推动因素

你可以把联邦公开市场委员会(FOMC)视为全球市场最大的推动者。美联储负责制定利率和美国货币政策,因此,他们的会议纪要让我们了解他们对全球最大经济体表现的判断以及他们可能采取的应对措施。

美联储在3月份会议上维持利率不变,并预测今年将降息两次,这与预期一致。然而,他们也补充称,“经济前景的不确定性有所增加”。这种不确定性的一个主要来源是关税。 如果美联储有理由相信关税将再次导致通胀失控,他们可能会放慢降息步伐,甚至在更长时间内维持高利率。

美联储最关注的一个关键指标将是消费者物价指数(CPI),它是衡量美国通胀压力的指标。2月份的最新数据暗示物价压力正在降温,CPI环比仅上涨0.2%,同比通胀率达到2.8%,略低于预期。然而,就在所有人都认为通胀已得到控制时,特朗普时代的关税政策却强势回归,引发了人们对物价飙升的担忧。如果美国3月份CPI数据过高,美联储可能面临在管理通胀风险和支持经济增长之间寻求平衡的局面。

欧元/美元:价格能否维持涨势?

德国近期增加国防开支,提振了该地区经济复苏的预期,并释放了5000亿欧元用于德国基础设施建设,从而推动欧元/美元近期上涨。如果美国3月消费者物价指数(CPI)意外上涨,美联储可能被迫重新考虑其宽松计划,从而引发市场波动和美元再度走强的风险,这可能会抑制欧元/美元的上涨势头。然而,如果美国CPI持续疲软,降息的可能性依然存在,这将使欧元/美元的前景更加复杂。

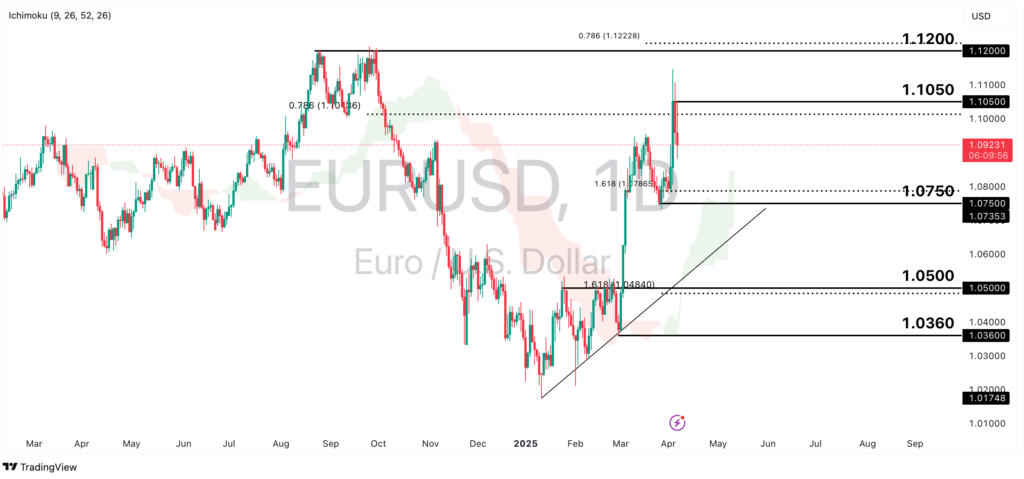

代码:EURUSD,时间范围:每日

欧元/美元自年初以来的看涨势头已重现,汇价维持在一目均衡图和上升趋势线上方。目前汇价正在回撤,并有望重新测试1.0750支撑位,该位与161.8%斐波那契回撤位一致。如果目前的势头持续下去,则可能进一步跌向1.1050和1.1200的阻力位,与之前的高点一致。然而,如果汇价出现更深的回撤并突破趋势线,则可能重新测试1.0500支撑位,该位与161.8%斐波那契回撤位一致。

美元兑人民币——密切关注中国人民银行的动向

在上周的种种喧嚣中,中国人民银行(PBoC)似乎正在放松对人民币的控制,但一项关键举措可能被忽视了。换句话说,中国人民银行允许人民币比以往更加自由地流动。

由于美元兑人民币1个月波动率仍然相对较低,这表明大多数交易员并未密切关注该货币对,因为其波动幅度充其量也微乎其微。请密切关注该货币对——人民币进一步走弱将推动美元兑人民币的看涨势头突破7.37,接近中国人民银行此前干预的水平,这将引发关注。

美国CPI数据走高可能会增加美联储长期维持高利率的风险。这或许会给美元离岸人民币带来初步提振,但如果经济衰退担忧加剧,则可能拖累更广泛的风险情绪,导致美元汇率陷入震荡区间,除非中国人民银行出手干预,降低基准利率。与此同时,美国CPI数据走弱可能会缓解经济衰退担忧,并在一定程度上缓解美元升温,从而支撑美元离岸人民币的看涨势头。

代码:USDCNH,时间范围:每日,来源:

从技术角度来看,美元兑人民币汇率已突破下行趋势线,目前维持在一目均衡图上方。进一步的看涨势头可能推动价格测试7.3650阻力位(与61.8%斐波纳契扩展位一致)和7.4100阻力位(与50%和100%斐波纳契扩展位一致)。然而,任何看跌转折点都可能使价格重新测试7.2800和7.2250的支撑位。

密切关注消费者物价指数 (CPI) 和联邦公开市场委员会 (FOMC) 会议纪要,以及美联储立场公布后市场波动加剧的可能性。请记住,特朗普时代关税的新闻报道可能会影响市场走势,因此请保持灵活,随时准备应对重大价格波动。

免责声明:本信息仅供教育用途,不构成投资建议。本文探讨市场对近期政策声明的反应,不构成任何政治背书或观点。内容未考虑您的个人目标、财务状况或需求。如有必要,我们建议您寻求独立建议。本信息并非根据旨在促进投资研究独立性的法律要求编制。对于其中包含的任何信息的准确性或完整性,我们不提供任何陈述或保证。本材料可能包含历史或过往业绩数据,不应依赖。此外,我们无法保证任何预估、前瞻性陈述和预测。本网站上的信息以及所提供的产品和服务不适用于任何国家或司法管辖区内的任何人士,如果此类分发或使用违反当地法律或法规。