TSMC stellar results help Tech; big banks jump

* US-Taiwan clinch deal to cut tariffs, boost chip investment

* Erosion of Fed independence would be ‘credit negative’ for US, Fitch says

* Morgan Stanley tops forecast, Goldman Sachs profit rises on dealmaking

* Stocks green but give back gains, USD breaks higher

FX: USD finally pushed higher after recent consolidation just below recent highs and the 50-day and 200-day SMAs at 99.02 and 98.77 respectively. Initial jobless claims posted the second lowest print in two years easing concerns around the labour market. President Trump said Iran has “no plan” to execute protestors helping soothe geopolitical concerns. Back in the US, Trump said he has no plans to remove Fed Chair Powell, whilst also speaking highly of the prospective new Fed Chairs Hassett and Warsh. Fedspeak was unsurprisingly rather mixed with opposing views from various officials, ahead of the blackout period this weekend for policy chat.

EUR broke down away from the 50-day SMA at 1.1650, after printing an inside day. That is a continuation pattern before the trend continues. The 200-day SMA sits below at 1.1579. Traded volatility in the world’s most popular currency pair remains near multi-year lows.

GBP dropped below the 200-day SMA at 1.3395 as the pound underperformed relative to its peers. GDP beat estimates and Q4 is on track to beat the BoE’s forecast of flat growth. With Budget uncertainty fading and New Year seasonality, some economists believe growth could hit 0.4% in the first quarter of 2026. We could also get an upside surprise in CPI next week.

JPY traded in a narrow range and printed an inside day as the major kept below the prior top at 158.87. Bloomberg reported that the BoJ is likely to keep rates steady next week, but some officials are said to be concerned over the economic impact of a weak yen. The piece added that if JPY continues to weaken, then the pace of future rate hikes could be accelerated.

US stocks: The S&P 500 added 0.26%, closing at 6,944. The Nasdaq moved higher by 0.32% to finish at 25,547. The Dow settled higher by 0.6% to close at 49,442. Energy was the big underperformer as crude prices fell on easing geopolitical tensions. Three other sectors were in the red, while Utilities and Industrials led the gainers, helping the Dow to outperform the tech heavy Nasdaq. The Mag 7 lagged the main indices modestly with a 0.17% advance. Investment bank earnings were in focus with both Goldman Sachs and Morgan Stanley reporting. They both reported bumper earnings capping Wall Street’s best year for big banks in four years. Four of the five big US houses this week reported an increase in quarterly fees from advisory work, with the Trump’s deregulation agenda expected to deliver a boom for the industry. TSMC, the world’s biggest chip maker jumped 4.4% after it posted blowout earnings which helped boost semiconductor names like Applied Materials and CoreWeave, up 5.7% and 5.8% respectively.

Asian stocks: Futures are mixed. APAC stocks were mostly in the green once more. The ASX 200 advanced on mining and material sector gains as metals continued higher. The Nikkei 225 underperformed, sliding back under 54,000 with reports that opposition parties are forming a new party denting sentiment. The Hang Seng and Shanghai Comp were mixed with Hong Kong holding around recent record highs while the mainland traded around flat.

Gold’s rally paused with prices holding just above the recent record highs. Investors assessed the slightly improving geopolitical situation between Iran and US, in so far as President Trump is said to be less inclined for military action.

Silver prices briefly tumbled from record highs after Trump said he is holding off on new tariffs targeting imports of critical minerals, easing near-term trade disruption risks. However, prices recovered much of the earlier decline, signalling that traders are repricing the market’s structural drivers.

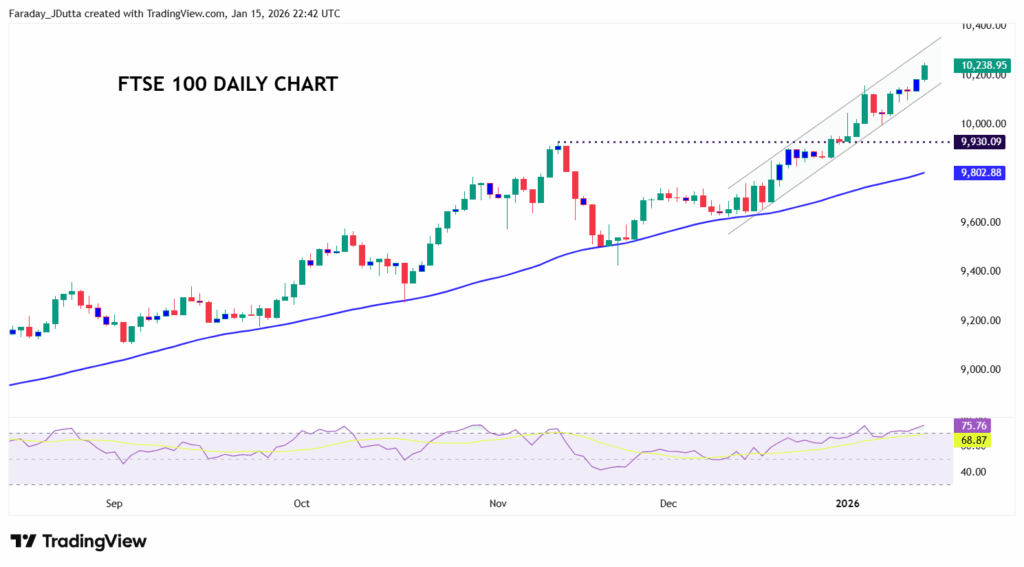

Chart of the Day – FTSE 100 hits record highs

After pausing and consolidating in bullish fashion at the end of 2025, the UK FTSE 100 has broken in textbook fashion to the upside. Many of its companies are global exporters benefiting from resilient world growth, higher commodity prices and a soft pound, which boosts overseas earnings when translated back into sterling. The index is also packed with dividend‑rich value sectors, like energy, miners, banks, insurers and defence). Investors looking for income and inflation protection as rates peak and stay relatively high are attracted to these sectors in contrast to high growth, Tech. In contrast to the latter, crucially UK blue‑chips still trade at a discount to their US and European peers. That means improving profit forecasts, buybacks and some M&A interest have encouraged investors to “re‑rate” the market from depressed levels.