Markets mixed as eyes turn to NFP and tariff ruling

* Wall Street mixed again as Dow Jones outperforms Nasdaq

* Defence stocks soar as Trump plans huge military budget boost

* Dollar slightly firmer again ahead of crucial NFP data

* US trade deficit unexpectedly falls to lowest level since 2009

FX: USD continued its bullish momentum after the low on December 24, as the index tapped the 200-day SMA at 98.87. The 50-day SMA is above at 99.08 so crossed above the longer-term SMA which signals a bullish golden cross. Weak oil prices haven’t impacted the greenback with seasonality positive around this time of the year. Jobs data was hot with initial jobless claims signalling a still solid labour market. We get the US Supreme Court ruling with consensus leaning to a negative ruling which could see dollar buying as markets reprice the Fed more hawkishly. All eyes are on today’s NFP data release.

EUR tapped the 50-day SMA at 1.1640. German factory orders printed well above estimates for November, delivering an unexpectedly strong 5.6% m/m print. A modest contraction had been expected, and the stronger data gave the euro some stability following softer inflation data released earlier this week.

GBP was modestly softer as bullish momentum has eased from overbought levels. The RSI is now hovering just above the neutral threshold at 50 after three days of selling. There has been little domestic data with broader sentiment dominating.

JPY softened for a third straight day as the major continued to trade in the 154.50/158 range seen since mid-November. Domestic releases have been soft, with notable weakness in the labour cash earnings data for November. Strong resistance sits just below 158 with markets on alert for verbal intervention by the Japanese authorities.

US stocks: The S&P 500 added 0.01%, closing at 6,921. The Nasdaq moved lower by 0.57% to finish at 25,507. The Dow settled higher by 0.55% to close at 49,266. Tech was the worst-performing sector with only Health also in the red, while Energy and Consumer Staples outperformed. Defence stocks jumped after President Trump said the military budget should be raised to $1.5 trillion from $900 billion. RTX, Lockheed Martin and Northrop Grumman all made back some of the prior day’s losses.

Asian stocks: Futures are mixed. APAC stocks eventually traded mostly negative following a similar handover from Wall Street. The ASX 200 traded marginally higher as strength in health care, tech, consumer stocks, energy and financials, offset the losses in mining and materials. The Nikkei 225 extended its decline beneath the 52,000 level amid soft wages data from Japan and further frictions with China. The Hang Seng and Shanghai Comp eventually traded negative with the Hong Kong benchmark pressured amid tech-related weakness and with some early pressure seen in China’s OpenAI rival Knowledge Atlas Technology a.k.a. Zhipu, during its Hong Kong debut.

Gold saw buyers through the day after some early selling, in a relatively quiet day ahead of NFP.

Day Ahead – US Non-Farm Payrolls, Canada Jobs

The marquee economic release of the week and likely month is the US monthly jobs report. Consensus expects 70k jobs to be added, a figure that has risen through the week, and just above the prior 64k. The previous few months data have been messy due to the government shutdown, so this will be the first ‘clean’ labour market number and the first big test of the new year too. The unemployment rate is predicted to tick one-tenth lower to 4.5%. Wage growth is seen picking up to 0.3% m/m.

An inline headline print would leave the 6-month average around 40k. That is lower than the 12-month average of 55k which means the jobs picture is cooler but not collapsing. At present it is a ‘low-hire low-fire’ labour market, taking into account other jobs data that implies an on-hold Fed in January as officials need to see substantially worse figures for more rate cuts. There’s just over two 25bps reductions priced in for this year with the first fully priced by June.

The Canada jobs headline figure is forecast to cool to a negative print after strength in recent months, with the prior reading at 53,600. The jobless rate is seen ticking up two-tenths to 6.7%. Trade-exposed sectors have stabilised at a lower level.

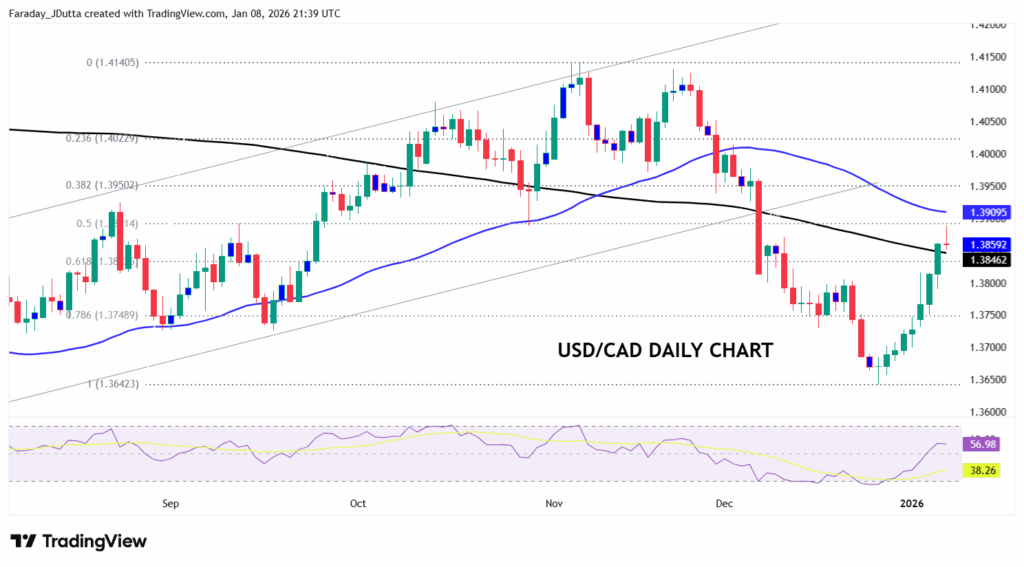

Chart of the Day – USD/CAD bouncing

The Canadian dollar is the worst-performing currency in the G10 since the weekend. Markets have been weighing an increased supply of Venezuelan oil in the future, which would disadvantage Canadian heavy, high-sulphur crude, which had been trading at a premium during Venezuela’s supply glut. The loonie is also having to negotiate the risks of USMCA renegotiation with major uncertainty potentially impacting the economy. That means increasing risk that the Bank of Canada may have to cut again in 2026. The major has bounced sharply after hitting a 6-month low over the holiday period. Resistance lies in the upper 1.38s which is the 50% retracement of the November/December USD decline and a major low from late October. The USD advance has cleared the 200-day SMA, with the 50-day SMA at 1.3909 in sight after nine straight days of gains.