If the artificial Intelligence (AI) revolution had a crown jewel, it would be undoubtedly be Nvidia Corporation (NASDAQ: NVDA).

What started as a company making chips for gamers has become the effective “face” of AI innovation, self-driving cars, cloud computing, and even scientific breakthroughs. Nvidia isn’t just riding the AI wave, it’s powering it.

But here’s the twist: Nvidia’s dominance doesn’t only make it a darling of Wall Street. It also makes the company a pawn in the world’s most important geopolitical contest amid the escalating technology rivalry between the US and China.

And when one company sits at the intersection of national strategy, economic competition, and market psychology, market participants may monitor these risks.

Think of Nvidia as the “Silicon OPEC.” Just as oil once dictated geopolitics, advanced chips now fuel digital economies, militaries, and future innovation. And like oil in the 20th century, access to cutting-edge chips in the 21st century has become a matter of national power.

Key Points

- Nvidia’s AI chips have become essential infrastructure, powering industries from data centres to autonomous driving, making the company central to global innovation.

- The US has tightened export restrictions on Nvidia’s advanced chips to China, prompting Beijing to accelerate domestic alternatives and launch regulatory pushback.

- Caught between growth in China and compliance with US rules, Nvidia symbolises how technology has become inseparable from geopolitics and global market risk.

The High Stakes of AI Chips

At first glance, Nvidia is just selling silicon. But that would be like saying Apple just sells phones or that Google just runs a search bar. The reality is far bigger. Nvidia’s chips aren’t simply components. They are the electricity of the digital age, powering the systems that define our future.

Just think of data centres. Every large language model, from ChatGPT to Google DeepMind, runs on the backbone of Nvidia’s graphics processing units (GPUs). Without them, the AI boom would stall before it even begins.

Then there’s autonomous driving. Tesla, BYD, and dozens of global automakers are building self-driving futures on Nvidia’s platforms. The company is the “engine under the hood” of tomorrow’s cars.

Beyond that, there are places where chips are having a huge impact but it might not be immediately obvious. One place is in healthcare and science. From simulating drug discovery to modeling climate change and even nuclear reactions, researchers rely on Nvidia’s computing power to crunch problems once thought unsolvable.

This is why semiconductors are no longer “just another tech sector.” They’ve become strategic infrastructure. Losing access to cutting-edge chips today would be like losing access to oil fields in the 1970s, a shock that could cripple economies, slow innovation, and tilt global power balances.

US Restrictions and China’s Pushback

Washington isn’t clueless about Nvidia’s outsized role. Over the past few years, the US government has rolled out a tightening web of controls on advanced AI chip exports to China. These aren’t just red-tape delays. They are deliberate attempts to choke off access to some of the most powerful levers of AI development.

- Export bans: Flagship GPUs such as Nvidia’s A100 and H100, among the fastest available for AI training workloads, are barred from being sold directly into China [1].

- Licensing & conditional sales: Even “watered-down” or scaled back chips (versions made to comply with US rules) are subject to licensing, stricter export controls, and in some cases revenue-sharing arrangements. This raises big uncertainties for future deals.

- Coalition diplomacy: The US isn’t acting alone. It has enlisted allies in Japan, the Netherlands, and Taiwan to tighten export/export-control regimes, preventing easy back-doors and second sourcing of restricted technologies.

China, in turn, has responded more forcefully than a passive buyer cut off from supply. It has not only accelerated efforts to build its own domestic chip stack, but taken regulatory, legal, and commercial steps directly aimed at Nvidia and similar foreign players.

Here are just some of the key moves by the world’s second-largest economy:

- Antimonopoly / competition probes: China’s State Administration for Market Regulation (SAMR) has opened a preliminary investigation into Nvidia, alleging violations of Chinese anti-monopoly laws. The focus is in part on Nvidia’s 2020 acquisition of Mellanox Technologies, specifically that Nvidia may have failed to meet conditions imposed at the time of merger approval.

- Security and “backdoor” concerns: Chinese regulators have also asked Nvidia to explain whether specific chips (like the H20, designed for China under US export licenses) pose security or data privacy risks. These are being used as grounds to limit or block procurement.

- Mandates & discouragements: China has reportedly ordered leading tech firms to halt purchases of certain Nvidia chips, especially those seen as “stripped-down” versions (e.g. chips like the B40 or versions of H20) that Beijing considers too tied to US dictates. The message is clear: relying on foreign chips isn’t just risky. It might be unpatriotic or problematic.

- Promoting domestic alternatives: Simultaneously, Beijing is pouring state support into its own chip designers and manufacturers (Huawei’s HiSilicon, SMIC, Alibaba’s T-Head, Moore Threads, others). New data-centres are being built using mainly domestic chips. Domestic PPUs (processing units) are being developed and showcased as competitors to Nvidia’s permitted offerings.

Caught in the middle of all this is Nvidia, a company for which China represents one of the largest growth opportunities, but also a space of rising regulatory risk.

Recent developments show how this squeeze is getting tighter: China has officially accused Nvidia of violating anti-monopoly law, following a probe about its Mellanox takeover.

Furthermore, the Chinese government has also expressed concerns about the H20 chip (the version that was licensed under restrictions), including potential security risks and whether its sales to China are compliant in practice [2].

Nvidia’s Dilemma: Growth vs. Compliance

Nvidia today finds itself squeezed between two powerful forces. On one side, Washington has made clear that selling too much computing power abroad risks penalties, investigations, and tighter restrictions.

On the other side, China remains a critical market, accounting for roughly a fifth of Nvidia’s demand, and showing no signs of reducing its appetite for high-performance GPUs.

This tug-of-war leaves Nvidia in a position where neither option is comfortable. Walking away from China would mean sacrificing one of its largest growth markets. But defying US policy could jeopardise its license to operate at home and threaten global credibility.

The company has tested several strategies to navigate this bind:

- “China-only” chips: Nvidia launched lower-power GPUs like the A800 and H20, designed to comply with US export rules while still supplying Chinese customers. Yet even these products have come under scrutiny as Washington repeatedly tightened definitions.

- Supply chain diversification: To reduce reliance on a single geography, Nvidia and its partners are gradually exploring manufacturing and assembly bases in Southeast Asia and India, though Taiwan’s TSMC remains the linchpin of production.

- Geographic balancing: Rising demand in the US, Europe, and emerging AI markets has provided Nvidia with a cushion, but China remains too significant to ignore.

The situation reflects a classic dilemma, where Nvidia faces trade-offs whichever path it takes.

Nvidia’s future growth path will depend not only on product innovation, but also on how successfully it navigates political negotiations and regulatory crosscurrents on both sides of the Pacific.

The Market View: Why Traders Should Care

Policy risk is no longer just a footnote in an analyst’s report. It has become a daily driver of Nvidia’s stock price. Market valuations have often reacted to policy news from Washington or Beijing, highlighting the sensitivity of Nvidia’s stock to geopolitical developments.

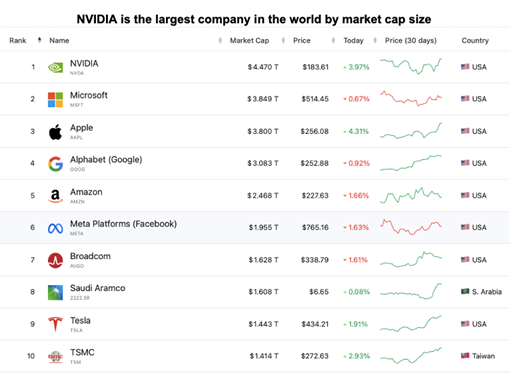

Consider this: Nvidia has now surpassed Microsoft Corporation (NASDAQ: MSFT) to become the world’s most valuable company, with a market capitalisation above US$4 trillion.

That meteoric rise has been fuelled by AI optimism. But with such lofty expectations, the stock is priced for perfection, and even whispers of policy shocks can spark double-digit swings.

The ripple effects extend well beyond Nvidia itself and investors have seen this “Nvidia effect” leach into other parts of the market:

- Semiconductor ETFs: Thematic ETFs such as the iShares Semiconductor ETF (NASDAQ: SOXX) and the VanEck Semiconductor ETF (NASDAQ: SMH) often show movements that analysts link to Nvidia’s performance, given the company’s large weight in these ETFs.

- Supply chain stocks: Global leaders, including ASML Holding N.V. (NASDAQ: ASML), Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM), Samsung Electronics Co Ltd (KRX: 005930), and Micron Technology Inc (NASDAQ: MU), are feeling the aftershocks.

- Currencies and trade: Export-heavy economies like South Korea and Taiwan often see their currencies and trade balances whipsawed by headlines tied to Nvidia and the broader semiconductor cycle.

For traders and investors alike, Nvidia has also become a widely watched reference point for global technology risk, a single name that encapsulates not just earnings potential, but the volatility of geopolitics itself.

Beyond Nvidia: A Symbol of a Larger Battle

It is tempting to think this is all about one company. But Nvidia is more like the “canary in the coal mine”. Behind the Nvidia story lies a much larger contest: who will control the future of artificial intelligence?

For the US, the goal is to maintain its technological lead and prevent rivals from leapfrogging. Meanwhile, for China, the aim is to achieve self-sufficiency, reduce reliance on foreign suppliers, and become a global leader in AI applications.

In that sense, Nvidia is less a company and more a symbol, a stand-in for an entire generation of technologies that could reshape economies and military balances.

Just as Boeing once symbolized aerospace or Standard Oil symbolised energy, Nvidia now represents the frontline of the AI age.

Prepare for Technology as Geopolitics

Nvidia’s journey from powering video games to becoming the world’s most critical supplier of AI chips has made it a symbol of both technological progress and geopolitical tension.

Its success has drawn it into the US-China tech rivalry, where Washington’s restrictions aim to slow Beijing’s AI ambitions, and China’s countermeasures push for independence from foreign suppliers.

Caught between protecting one of its largest growth markets and complying with US rules, Nvidia embodies the reality that technology is now inseparable from geopolitics.

For market observers, this suggests that traditional measures like revenue, margins, and R&D pipelines may not fully capture the risks; policy decisions in Washington, Beijing, and Brussels are just as important in shaping outcomes.

In the context of global markets, Nvidia is not just another company but a focal point where technological progress and geopolitics intersect, with great powers moving their pieces around it. The stakes are high: the contest could influence who dominates AI and who may shape the next era of global economic and political power.

Reference

- “Nvidia AI chips: repair demand booms in China for banned products – Reuters”. https://www.reuters.com/world/china/china-repair-demand-banned-nvidia-ai-chipsets-booms-2025-07-24/ . Accessed 24 Sept 2025.

- “China cautions tech firms over Nvidia H20 AI chip purchases, sources say – Reuters”. https://www.reuters.com/world/china/china-cautions-tech-firms-over-nvidia-h20-ai-chip-purchases-sources-say-2025-08-12/ . Accessed 24 Sept 2025.