Stocks bid amid much cooler US Inflation

* US inflation unexpectedly slowed to 2.7% in November

* ECB keeps rates unchanged as prospects brighten

* BoE cuts interest rates, but hawks keep a tight rein on guidance

* US stocks rise on slower CPI, Tech leads the way

FX: USD printed an inside day candlestick, with price rises capped by the 100-day SMA at 98.60. CPI came in sharply lower than expected, though no monthly readings were released due to the government shutdown. Notably, the core was 0.2% lower than the lowest forecast on Bloomberg. This signalled some scepticism to the data due to possible collection issues. That said, Fed Chair Powell sounded relaxed about inflation last week and several components drove prices lower, including food and shelter. Otherwise, there were dovish comments from Fed’s Waller, who is an outside bet for the next Chair.

EUR was modestly lower on ECB day. The ECB is in a ‘good place’ in policy terms, as expected, and neutral for a prolonged period of time. Keeping optionality for future meetings is key, amid a relatively benign macro outlook. Staff projections were also as predicted, with stronger GDP and slight upward inflation forecasts. Lagarde is not for turning, (to coin a phrase) while the euro needs to get above this week’s spike high at 1.1804 for more upside.

GBP found a bid initially after the mildly more hawkish than expected 25bps BoE rate cut to 3.75%. The vote was perhaps narrower than predicted (5-4) while future decisions would become a ‘closer call’ – as rates are now closer to neutral (around 3-3.5%). Officials said wage growth appeared to have levelled out so may not have further to fall. There is one more round of CPI and jobs data before the next BoE meeting in February. Cable got to an intraday high at 1.3446 before paring gains and only just settling in the green on the day. The recent top from Tuesday is 1.3455 and buyers need to push beyond here for more upside. The 200-day SMA sits at 1.3350 with the 100-day SMA just above at 1.3362.

JPY was relatively quiet along with other majors. Markets await the BoJ expected rate hike and key guidance around policymaker’s next steps. See below for more on the decision. A minor Fib level of this year’s high to low move sits at 154.81 with the 50-day SMA just below at 154.30.

US stocks: The S&P 500 added 0.79%, closing at 6,775. The benchmark index continues to trade around the 50-day SMA at 6,765. The Nasdaq moved higher by 1.51% to finish at 25,019. The Dow settled higher by 014% at 47,952. Consumer Discretionary, Communication Services and Tech led the gainers, while Energy was the big underperformer as crude slid. Stellar Micron earnings and guidance on Wednesday night boosted the mood, while reports that OpenAI is set to raise billions at a $750bln valuation also lifted sentiment. It indicated strong investor appetite in the AI space, after some of fresh concerns last week following Broadcom and Oracle earnings.

Asian stocks: Futures are green. APAC stocks were mostly lower due to tech-led selling Stateside and ahead of US inflation data and upcoming central bank decisions. The ASX 200 was flat with the index muted by weakness in energy, gold miners and industrials. The Nikkei 225 briefly dipped beneath the 49,000 level amid tech woes and anticipation of a BoJ rate hike. The Hang Seng and Shanghai Comp were mixed as tech-related headwinds dampened risk sentiment in Hong Kong.

Gold printed an inside day as it continued to consolidate just below the record high of $4,380 from October. Tight supply and robust demand for hard assets have driven precious metal more broadly in recent months, and this year too. Fiscal strain and fragmentation are likely to be enduring themes in 2026.

Day Ahead – BoJ Meeting

The Bank of Japan is widely expected to hike the policy rate by 25bps to 0.75%. A ramp up in hawkish comments from bank officials has been heard in the last few weeks. Governor Ueda has framed a hike as “easing off the accelerator”, meaning financial conditions would remain broadly supportive. His decision will hinge on wage trends and a review of domestic and global economic data. Wage driven inflation is key to the policymaker’s view on neutral, with another hike not priced in until September 2026. There has also been reduced opposition from the new PM and her government, which saw increased bets on a move. We will be watching the tone and guidance of Ueda and any hints on further policy normalisation.

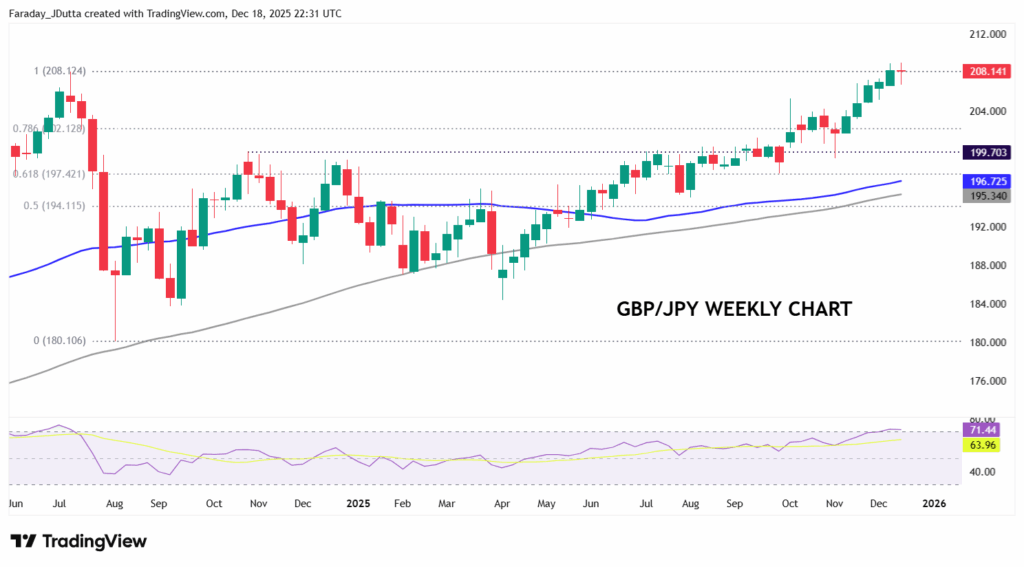

Chart of the Day – GBP/JPY hits key long-term resistance

This heavily popular and traded currency pair has enjoyed four straight months of gains and likely six-week win streak. That’s the most since a seven-week run in mid-2023. We highlighted the break of 199.70/200 a few months ago as key for more upside. The pop higher went above 205 and saw overbought conditions which were followed by a pause for breath, when prices briefly traded under the 50-day SMA. But bullish momentum returned after a one-day dip below 200 again, that saw strong buying up to 206 and now more recently 208. The long-term high from July 2024 is 208.12. Above this is the July 2008 top 215.89 as the next major peak.