Stocks bid as hopes of government reopen boost sentiment

* Wall Street rallies on US shutdown optimism, tech rebounds

* Gold climbs to two-week highs as soft data cements rate cut bets

* Yen, CHF lower as safe haven bid recedes, AUD and CAD outperform

* Bessent says Trump’s $2,000 dividend may come via tax cuts

FX: USD was very mildly bid with the dollar relatively quiet on the government shutdown end approaching. High-beta risk currencies may benefit more than the greenback. The 200-day SMA at 100.25 has also got some attention as resistance, along with last week’s weak jobs and consumer sentiment figures. While no (economic) news has been good for the dollar, government re-opening could see more cautious trade, with the slow release of economic data shaping the Fed’s policy into year-end.

EUR paused after three straight days of gains closed last week. Increased Fed rate cut expectations had helped the euro. There’s little eurozone data this week. Near term resistance is at 1.1591 and then the 50-day SMA at 1.1664.

GBP was mid-pack among the majors, with now a four-day rebound from multi-month lows. There’s been a mild rise in UK-US yield spreads which have helped sterling, even though the odds of a BoE December rate cut are firm. Jobs data is released today.

JPY was the major laggard on upbeat risk sentiment, though Treasury yields didn’t respond positively. Initial resistance sits around 154.44/48. New PM Takaichi reaffirmed her comments about central bank independence. BoJ officials also leaned mildly hawkish as the ‘fog surrounding Japan’s economic outlook has begun to clear, compared with July.’

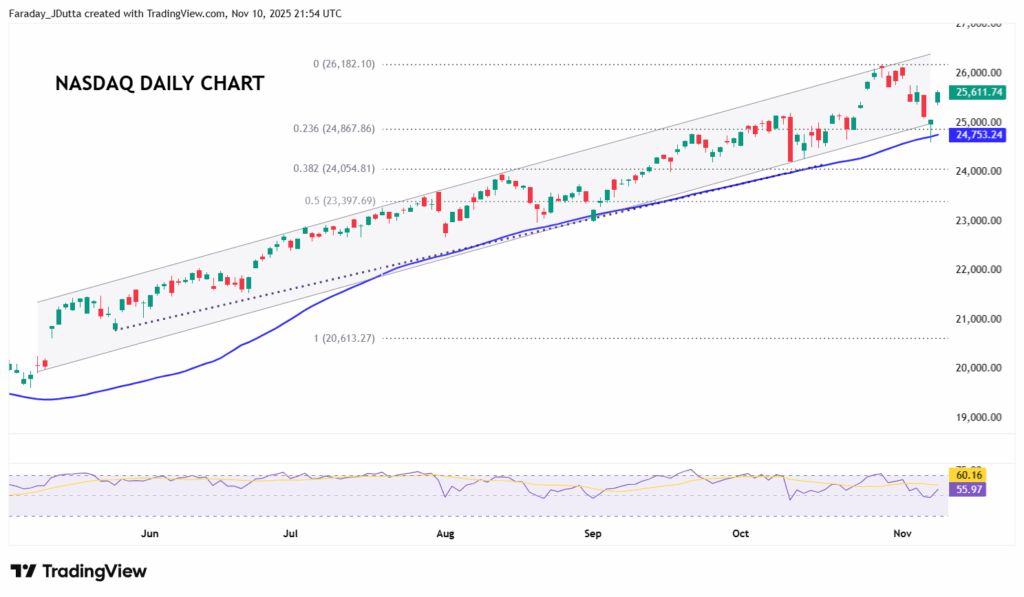

US stocks: The S&P 500 gained 1.54%, closing at 6,832. The Nasdaq moved higher by 2.2% to settle at 25,612. The Dow Jones finished at 47,369, up 0.81% on the day. All sectors were green apart from three with Tech, Communication Services and Consumer Discretionary up from 2.69% to 1.49%. Those mega-cap sectors outperformed with all Mag-7 names in positive territory. Consumer Staples was one of few sectors in red and saw a lack of demand due to its risk-off defensive characteristics. Nvidia surged 5.8% and Palantir added 8.8% after progress in Washington to end the 40-day and longest government shutdown. ‘Buy the dip’ has once again lifted tech and AI stocks after both the S&P 500 and the Nasdaq bounced off their 50-day SMAs as support. Eli Lilly rose 4.6% to a record high

Asian stocks: Futures are positive. Stocks traded higher after hopes of the US government shutdown ending sparked optimism. The ASX 200 moved higher led by miners and tech, while disappointing ANZ figures didn’t dent financials. The Nikkei 225 rallied on the weaker yen and earnings. The Hang Seng and Shanghai Composite were both bid on improved US-China trade relations though inflation data printed hotter than expected.

Gold surged over 2.8% as Treasury yields fell though the dollar steadied. Markets weighed signs of economic weakness versus the end of the government shutdown. Attention may get drawn to the poor US fiscal outlook after President Trump offered up $2,000 tariff dividends to low-income families.

Day Ahead – UK Jobs

Jobs data, and specifically wage growth, has been a key metric for the BoE as it feeds into inflation figures. The headline earnings metric is forecast to remain at 5.0% and the ex-wage figure is likely to moderate to one-tenth to 4.6%. September’s unemployment rate is expected to tick up to one-tenth to 4.9%, with the three-month number predicted to cool to around 4.3%, somewhat lower than the BoE’s 4.7% forecast.

The series comes after last week’s November BoE meeting and the and the big focus on inflation. Wage data could provide some early comfort to Governor Bailey, the swing voter on the heavily divided MPC, which saw a closer than expected 5-4 vote to keep rates on hold last week. Overall, the data will add some colour to the underlying inflation picture, but markets are primarily waiting for the next two CPI prints on November 19 and December 17, and the November 26 Budget before the December BoE rate decision. There’s a near 70% chance of a 25bps rate cut at the final meeting of the year.

Chart of the Day – Nasdaq back into bull channel

The tech-heavy Nasdaq index suffered last week, falling over 3% in its worst week since April. Investors got worried about sky-high valuations with the combined market value of 8 of the most valuable AI-related stocks – including Nviida, Meta and Palantir – losing around $800bn. Concerns over AI-related capex have risen, with Meta, Alphabet and Amazon reporting over $110bn of AI investments in the third quarter, as they are increasingly debt-financed. But the end of the US government shutdown has seen investors buy the dip after prices fell out of the long-term ascending channel. The index also bounced off its 50-day SMA at 24,748. The recent record high at 26,182. A seasonal melt-up could still be on which we wrote about in a previous Week Ahead.