- Trading

Trading

-

CFD Trading

What is CFD Trading How to Trade CFD Why Trade CFD CFD Trading Strategies

- All Trading Products

-

Markets

All Instruments Forex CFDs Indices CFD Commodities CFD Stocks CFD ETFs CFD Bonds CFD Cryptocurrency CFDs

- Trading Accounts

- Trading Fees

- Trading Leverage

- Trading Server

- Deposit & Withdrawal

- Premium Services

-

CFD Trading

- Platforms

- Academy

- Analysis

- About

-

AllTradingPlatformsAcademyAnalysisAbout

-

Search query too short. Please enter a full word or phrase.

-

Keywords

- Trading Accounts

- TradingView

- Trading Fees

Popular Search

- Trading Accounts

- MT4

- MT5

- Professional Trading Accounts

- Academy

Trading in the world’s largest financial market, forex, using CFDs (Contracts for Difference) may seem complex at first, but with the right understanding, it can become manageable and potentially beneficial. This guide will focus on trading Forex CFDs. It will walk you through everything you need to know to start trading forex CFDs confidently, from understanding the basics to placing your first trade.

How to Trade Forex CFDs?

Successful forex CFD trading requires a solid understanding of the market and a clear strategy. Start by choosing a reliable broker, setting up an account, and learning to analyse the market and place trades. Effective risk management and a disciplined approach are key to managing losses and improving your results.

In this guide, you’ll learn:

- The basics of forex CFD trading

- Steps to set up your trading account

- How to place your first forex CFD trade

- Risk management strategies specific to CFDs

- Different ways to trade forex CFDs

By learning the fundamentals, you’ll be better equipped to make informed decisions and maximise your trading potential. This guide focuses primarily on trading forex using CFDs — a popular method with both potential rewards and risks.

Steps to Begin Forex CFD Trading

Here are a few simple steps to help you get started with forex CFD trading:

Step 1. Understanding the Forex Market

Forex trading involves buying one currency while selling another, known as currency pairs. These pairs are categorised into majors, minors, and exotics, each representing different economies. For example, EUR/USD (Euro/US Dollar) is one of the most actively traded major pairs globally.

Learn More: Check out this beginner-friendly guide about what is forex.

Step 2. Research and Select a Trusted Broker

Before making your first forex CFD trade, you’ll need to look for a broker that is right for you. Take time to look for a broker that offers tight spreads and provides a user-friendly trading platform. Ensure that the broker aligns with your trading goals and risk tolerance.

At Vantage, you can trade forex CFDs with competitive spreads, reliable trade execution, and have full access to a comprehensive suite of free educational materials. Remember that leverage magnifies both potential profits and losses when trading CFDs. Never trade with money you can't afford to lose. Whether you’re a beginner or a seasoned trader, our advanced charting tools and award-winning customer support make trading seamless and secure.

Step 3. Set Up Your Forex CFD Trading Account

Opening a forex CFD trading account is straightforward. Here’s what you’ll need:

- Personal information (name, address,)

- Financial background details

- A valid ID for verification

At Vantage, you can choose between a demo account to practice risk-free or a live account to start trading with real funds.

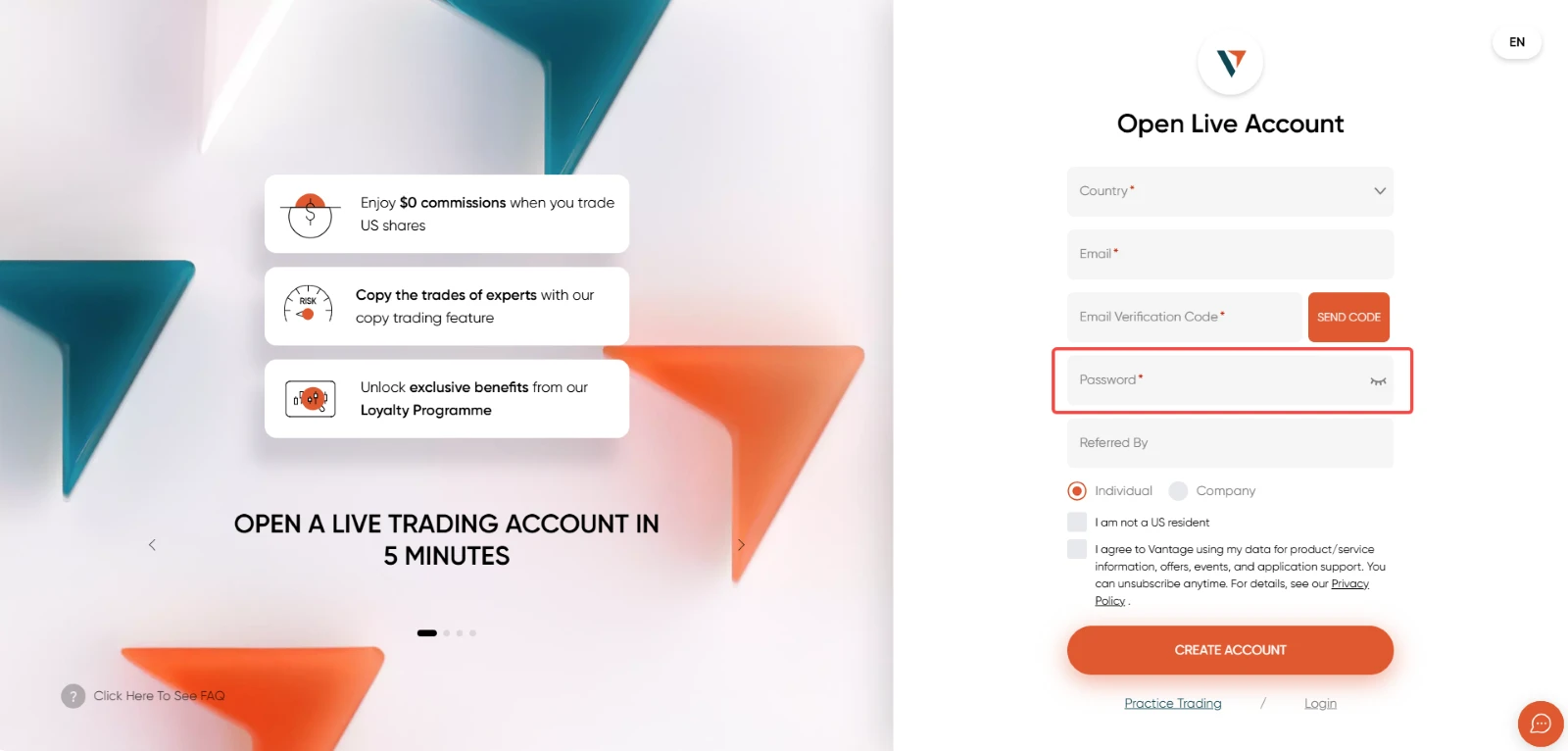

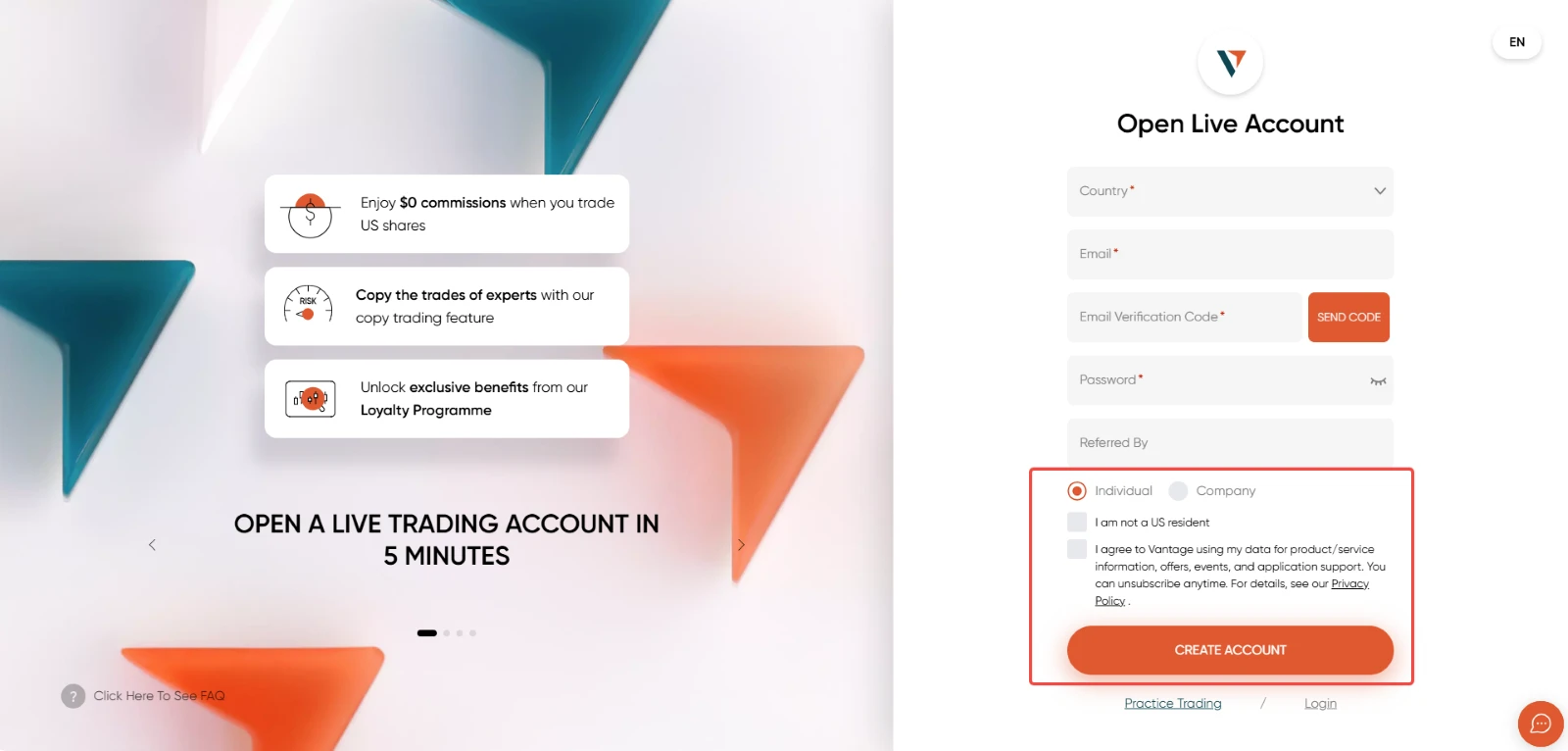

How to register with Vantage :

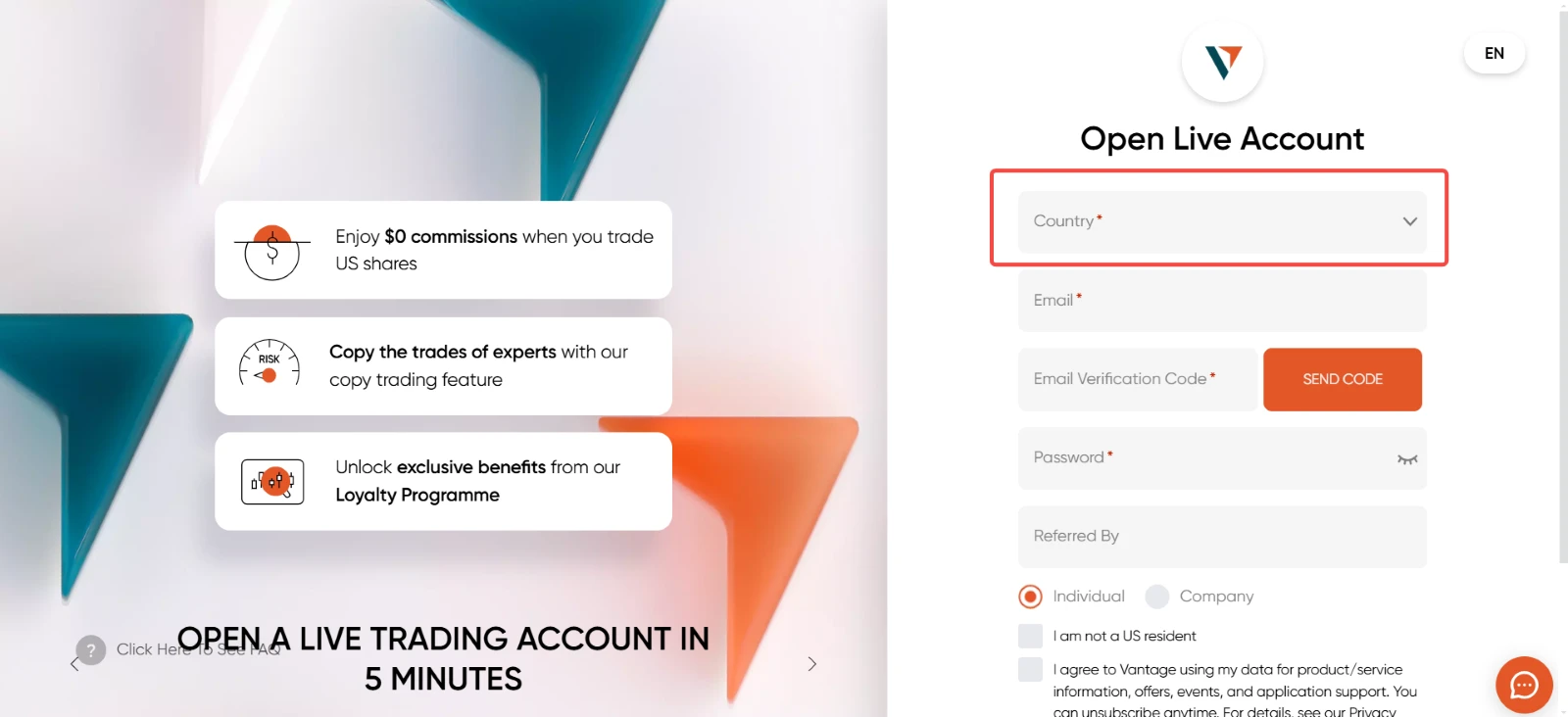

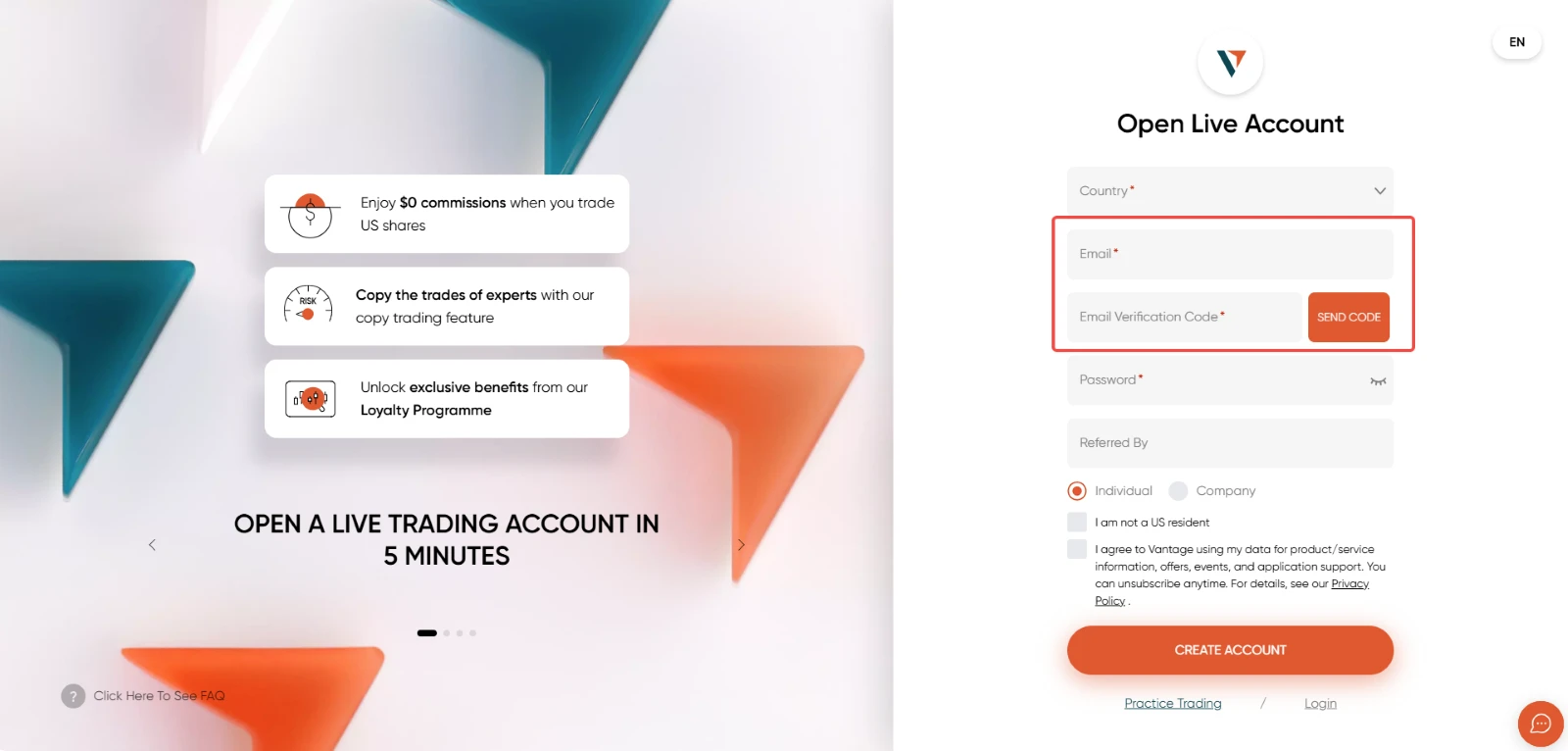

1. Visit the Vantage website and click on “Register”. Or, open live account here

2. Select your country of residence in the dropdown list.

3. Enter your email address and click on ‘Send Code’ for verification.

4. Fill in your password.

5. Enter your unique referral link if applicable and tick the boxes that apply to complete your registration.

Step 4. Use Forex Trading Platforms

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most popular trading platforms in the forex market, trusted by millions of traders worldwide.

MT4 is known for its user-friendly interface, advanced charting tools, and support for automated trading through Expert Advisors (EAs).

MT5 builds on this foundation, offering additional features like more timeframes, an economic calendar, and the ability to trade stocks and commodities alongside forex.

Both platforms provide real-time market data, customisable indicators, and seamless execution, making them ideal for traders of all experience levels who are trading CFDs.

Step 5. Place Your First Trade

Once your account is set up, you’re ready to place your first trade. Here’s how:

- Choose a currency pair: Major pairs like EUR/USD or GBP/USD are commonly chosen by traders.

- Decide to ‘buy’ or ‘sell’: If you anticipate that the base currency will appreciate, choose to buy. If you expect it to depreciate, opt to sell.

- Set your stops and limits: Use stop-loss orders to limit potential losses and take-profit orders to lock in gains.

Step 6. Manage Your Risks

Forex trading is inherently volatile, making risk management crucial. Effective risk management is especially crucial when trading leveraged products such as forex CFDs. Here are some tips:

- Use stop-loss orders to protect your investments.

- Diversify your trades to spread risk. However, do bear in mind that

diversification does not guarantee a profit or protect against loss in a declining market.

By managing your risks effectively, you can safeguard your capital and trade with confidence.

Learn Different Ways to Trade Forex

There are multiple ways to trade forex, each to suit different trading styles and goals. They also differ in how currencies are traded. Here are some popular options:

Spot Forex Trading

In the spot market, currencies are traded immediately at the current, or spot, price. This also means that monetary transactions are the quickest here, with settlements usually taking no less than a day or two.

Forex CFDs

Forex Contracts for Difference (CFDs) let traders speculate on currency pair price movements without owning the asset. Trade on margin with a fraction of the total value, enabling both long (buy) and short (sell) positions. Unlike traditional Forex, CFDs don’t involve physical ownership, offering a flexible and accessible trading option. Leverage can magnify both profits and losses.

Forex Futures and Options

Forex futures involve agreements between buyers and sellers to exchange currencies at a predetermined price and future date, with settlement requiring only the outstanding value rather than the actual exchange of currencies. These contracts are often used to hedge against anticipated fluctuations in currency values.

On the other hand, forex options are financial derivatives based on underlying currency pairs, offering traders flexibility through various prices and expiration dates.

Explore More About Forex Trading

-

What Is Forex

Learn the basics of Forex trading, including how it works and why it’s a popular market for traders worldwide.

-

Why Trade Forex

Find out the unique benefits and advantages that trading forex can offer, and why any serious trader should consider this dynamic market.

-

Forex Trading Strategies

Explore Forex trading strategies via CFDs to help you navigate potential market opportunities while managing risks.

Award-Winning Broker

-

Best Broker

AustraliaInternational Business Magazine

-

Best Customer

Support AustraliaInternational Business Magazine

-

Best Overall Broker –

AustraliaInternational Business Magazine

Trade Forex CFDs On All Trading Platforms

MetaTrader4

- 30 built-in technical indicators

- 31 analytical charting tools

- 9 time-frames

- 4 types of trading orders

MetaTrader5

- 38 built-in technical indicators

- 44 analytical charting tools

- 21 time-frames

- 6 types of trading orders

TradingView

- 15+ chart types

- 100+ in-built indicators

- 50+ drawing tools

- 12 alert conditions

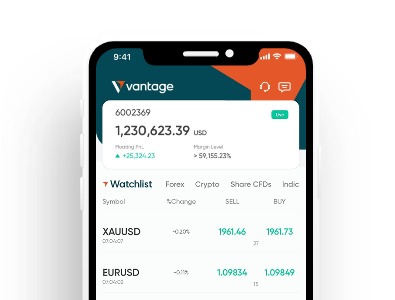

Vantage Mobile App

- 55 deposit methods globally

- 220+ daily product analysis

- 16 TradingView indicators

- 80,000+ copy traders

Choose a Trading Account Based on Your Experience Level

-

1

Beginner Traders

-

2

Experienced Traders

-

3

Professional Traders

High Volume Traders

- For traders looking for low and competitve commission, with only $1 per standard FX lot per side.

-

1

Register

Quick and easy account opening process.

-

2

Fund

Fund your trading account with an extensive choice of deposit methods.

-

3

Trade

Trade with spreads starting as low as 0.0 and gain access to over 1,000+ CFD products.

Frequently Asked Questions

-

1

How to start forex CFD trading?

To start forex CFD trading, open an account with a reliable broker like Vantage, fund your account, and begin trading using a platform like MT4 or MT5. Remember the risks of trading forex CFDs, including leverage. -

2

How to learn forex CFD trading?

Begin with the basics, practice on a demo account, and explore educational resources at the Vantage Academy, including webinars, courses, and guides. -

3

How to trade forex CFDs for beginners?

Start by learning the basics of currency pairs and how the forex market works. Then set up a demo account to practise trading with virtual funds, and develop a trading strategy before transitioning to live trading. -

4

How to trade currency CFDs?

Currency trading involves buying one currency while selling another, known as a currency pair. To get started, analyse the market to identify trading opportunities, choose a currency pair, and decide whether to buy or sell based on your market analysis. -

5

How much money do I need to start trading forex CFDs?

You can start with as little as $100, depending on your broker and trading strategy. Be aware of the risks of leverage and fees associated when trading with a small amount. -

6

Is trading forex CFDs difficult?

Forex CFD trading requires knowledge and practice, but with the right tools and guidance, it becomes manageable. -

7

What are the risks of forex CFD trading?

Forex CFD trading carries risks like market volatility, high leverage, and geopolitical events. Effective risk management strategies are crucial to minimising potential losses and protecting your capital. Only trade with capital you can afford to lose.

Disclaimer: The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.